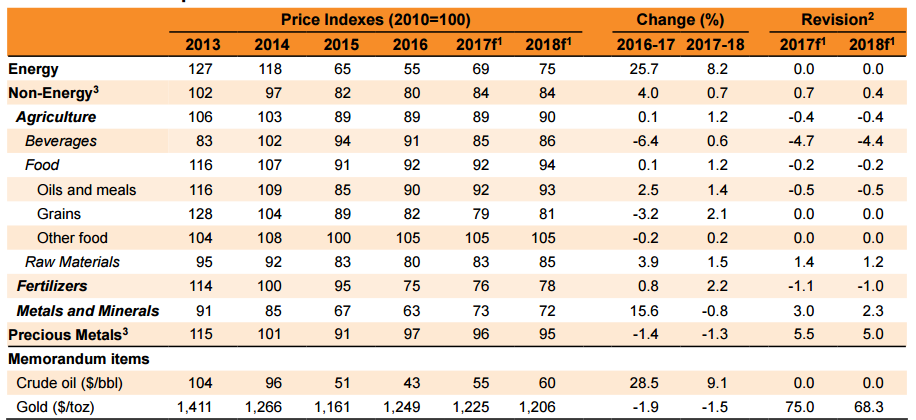

Prices for most industrial commodities strengthened further in the first quarter (q/q), while global agricultural prices remained broadly stable. Crude oil prices are forecast to rise to an average of $55 per barrel (bbl) in 2017 from $43/ bbl in 2016. The oil forecast is unchanged since October 2016 and reflects balancing forces: upward pressure on prices from production cuts agreed by Organization of Petroleum Exporting Countries (OPEC) and non-OPEC producing countries, and downward pressure from persistently high stocks, supported by the faster-than-expected rebound of the U.S. shale oil industry.

Metals prices are projected to increase 16 percent as a result of strong demand in China and various supply constraints, including labor strikes and contractual disputes in the case of copper, and environmental and export policies for nickel. Agricultural commodity prices, which gained 1 percent in the first quarter, are anticipated to remain broadly stable in 2017, with moderate increases in oils and meals and raw materials offset by declines in grains and beverages.

Recent trends

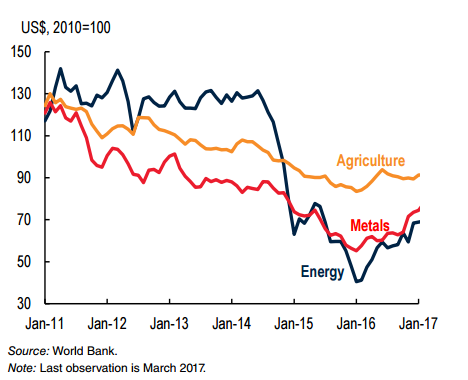

Energy prices rose 6 percent in the first quarter of 2017 (q/q), led by an 8 percent increase in crude oil (Figure 1). Natural gas prices in Europe and liquefied natural gas (LNG), both partly linked to oil prices, gained 16 and 7 percent, respectively, due to strong demand and a tight LNG market. U.S. natural gas prices fell 1 percent on lower demand as a result of mild weather. Coal prices fell 13 percent as supplies rebounded after China relaxed production limits.

Crude oil prices jumped 8 percent in 2017Q1, averaging nearly $53/bbl. Prices dropped below $50/bbl in early March on concerns over commitments to the OPEC/non-OPEC cuts, larger-than-expected U.S. crude oil inventories, and a robust recovery in U.S. shale oil activity. However, prices recovered in early April, although with continued volatility, on renewed expectations of tightening supply and an extension of OPEC/non-OPEC production agreement. Over the course of 2017, the oil market is expected to rebalance on steady growth in demand and lower production from OPEC and some non-OPEC countries. Crude oil inventories have remained high, mainly in the United States, but are expected to start declining in the second quarter as seasonal refinery demand picks up.

Non-Energy commodity prices rose 4 percent in 2017Q1 with large variations among major groups.

Agricultural prices gained 1 percent (Figure 1), but with large price movements among individual components, especially tropical commodities. Beverage prices declined nearly 7 percent due to a supply-driven collapse of cocoa prices. Raw materials prices strengthened, led by a surge in natural rubber prices following flood-related supply disruptions in Southeast Asia. Grain prices increased nearly 4 percent, mostly in response to gains in maize prices, while oils and meals prices rose a modest 2 percent on a general strengthening of edible oil prices. Metals prices surged by 10 percent, driven by strong demand and various supply constraints. Precious metals prices fluctuated widely on changing investor sentiment.

Figure 1 Commodity price indexes, monthly

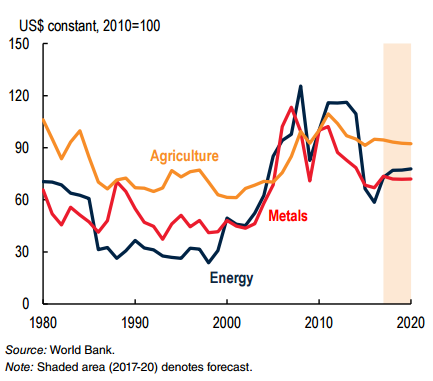

Figure 2 Commodity price indexes, annual

Outlook and risks

Energy prices are projected to increase 26 percent in 2017 and an additional 8 percent in 2018 (Figure 2, Table 1). Non-energy prices are expected to increase 4 percent in 2017, a 1 percent upward revision from January, and the first annual increase after five consecutive declines.

Oil prices are projected to average $55/bbl in 2017, unchanged from the January 2017 forecast. The oil market is expected to tighten in 2017Q2, mainly as a result of OPEC/non-OPEC production cuts. Prices are projected to increase to $60/bbl in 2018 as the market regains balance, with shale production limiting larger price gains. Upside price risks include greater-than-expected compliance by OPEC/nonOPEC producers and supply outages among some exporters, notably Libya and Nigeria. On the downside, weak compliance with the OPEC agreement and rising output from elsewhere, especially the United States, could delay rebalancing, as would slower demand growth. A faster-than-expected rise in U.S. shale oil production could also affect the supply balance.

Natural gas prices are projected to rise 15 percent in 2017, led by a 20 percent jump in U.S. gas prices on strong domestic demand and rising exports. Moderate price increases are expected in Europe and Japan due to higher oil prices. Coal prices are expected to average 6 percent higher in 2017 due to policy-induced supply reductions in China in 2016. Beijing’s coal policy will be a key determinant for prices given that China consumes half of the world’s coal output.

Agricultural prices are expected to remain stable in 2017, but there is considerable variation across commodities. Grain prices are projected to decline 3 percent this year, unchanged from the January projection, as favorable growing conditions have pushed stocks-to-use ratios (a measure of supply relative to demand) of all key grains to 15-year highs. However, oils and meals prices are projected to increase 3 percent amid tight supplies in East Asian and South American supplies.

Beverage prices are forecast to decline 6 percent in 2017, a downward revision from January, due to large cocoa supplies from West Africa. Raw materials prices are projected to gain 4 percent because of a supply shortfall in natural rubber. The end of the El Niño/La Niña cycle, which began in late 2015, limits upside risks to 2017-2018 agricultural price forecasts. Key downside risks are increased government use of agricultural support policies and energy price fluctuations, as agriculture is an energy-intensive sector. Fertilizer prices are projected to increase 1 percent, but markets remain well supplied.

Metal prices are forecast to increase 16 percent in 2017 (after dropping nearly 7 percent in 2016) on strong demand and tightening markets for most metals. The largest gains are expected in zinc (32 percent) and lead (18 percent) due to mine supply closures (resource exhaustion) and discretionary shut-ins in several countries. Copper prices are expected to increase by 18 percent as a result of various disruptions at some of the world’s largest mines—strikes (Chile), export policies (Indonesia), and bad weather (Peru). Downside price risks for metals include slow growth in China and greater-than-expected production, including restart of idled capacity. Upside risks stem from stronger-than-expected demand, policy-induced supply restraints in Asia, environmental constraints, and impending labor negotiations.

Precious metals prices are projected to decline by 1 percent in 2017 and a further 1 percent in 2018 as benchmark interest rates rise and safe-haven buying ebbs.

TABLE 1 Nominal price indexes and forecast revisions

Source: worldbank.org