Nidec Control Techniques is part of the Japanese Nidec Group, a global leader with over 50 years of expertise in the design and manufacture of variable frequency drives (VFDs). The company provides advanced motor control solutions (AC, DC, and Servo), optimizing performance and energy efficiency in complex industrial automation environments. Our portfolio includes world-renowned ranges such as Commander and Unidrive M, widely utilized across sectors including elevators, packaging, pumping, and robotics.

News

Volkswagen Group and Qualcomm Technologies have signed a Letter of Intent for a long-term supply agreement focused on next-generation infotainment, connectivity, and automated driving technologies powered by Snapdragon® Digital Chassis™ solutions. Under the intended agreement, Qualcomm would become a primary technology partner for Volkswagen Group’s zonal software-defined vehicle (SDV) architecture, developed for the Western hemisphere through its joint venture with Rivian Automotive.

Dacia has crowned itself the new powerhouse of the Dakar Rally, fending off a formidable field of Ford Raptors to claim its maiden victory in the legendary endurance race, achieved in just its second appearance. At the center of the triumph was Qatari star Nasser Al-Attiyah, who sealed a record-extending sixth Dakar win. Dacia delivered a commanding performance throughout the rally, overcoming a navigation error on Stage 9 that briefly cost Al-Attiyah the overall lead.

The energy price index slipped 1.3% in December, led by a 9.0% drop in Europe natural gas and a 4.4% fall in Australia coal prices, partly offset by a 12.1% surge in U.S. natural gas.

The non-energy index rose 1.3%.

Volkswagen subsidiary PowerCo has officially brought its Salzgitter gigafactory in Germany online, commencing production of its first Unified battery cells manufactured in Europe. According to Volkswagen, this marks the first time the Group has designed, developed, and produced battery cells entirely within Europe. The newly produced cells will be supplied to Volkswagen Group brands for final road testing, with initial deployment planned for next year in the Electric Urban Car Family, including models from Volkswagen, ŠKODA, and SEAT/CUPRA.

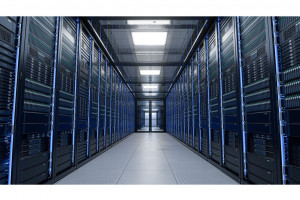

Siemens and nVent are partnering to develop a liquid cooling and power reference architecture specifically designed for hyperscale AI workloads. The modular blueprint is intended to help data center operators deploy AI infrastructure more quickly, intelligently, and sustainably. The joint reference architecture is designed to support 100 MW hyperscale AI data centers capable of housing large-scale, liquid-cooled AI platforms such as NVIDIA DGX SuperPOD with DGX GB200 systems.

The BMW Group and Encory GmbH have officially commissioned the new Cell Recycling Competence Center (CRCC) in Salching, Lower Bavaria. This milestone marks a significant advance in the joint implementation of an innovative direct recycling process. For both the construction and operation of the new facility, BMW Group and Encory are working closely with regional partners.