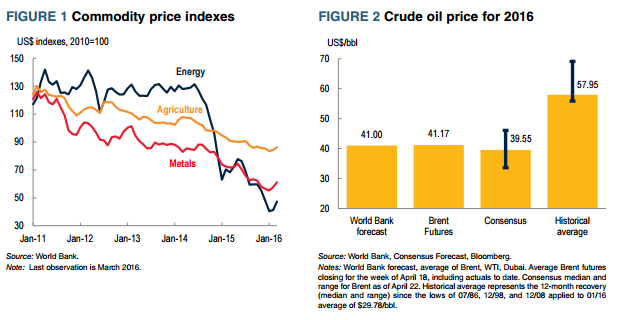

Most commodity price indexes rebounded in February-March from their January lows on improved market sentiment and a weakening dollar. Still, average prices for the first quarter fell compared to the last quarter of 2015, with energy prices down 21 percent and non-energy prices lower by 2 percent.

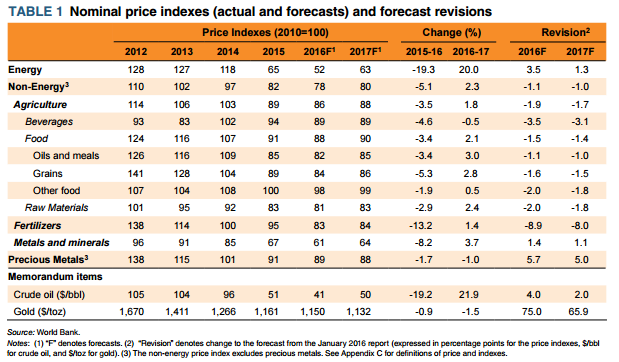

Given the recent rebound in oil prices and expected supply tightening in the second half of the year, the crude oil price forecast for 2016 has been raised to $41 per barrel (bbl), up from $37/bbl in the January assessment (and represents a drop of 19 percent from 2015.)

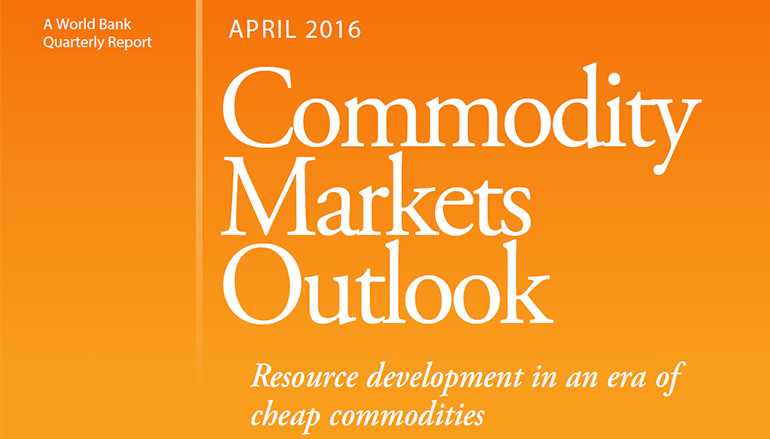

Metals prices are projected to decline 8 percent, a slightly smaller drop than anticipated in January due to supply reductions. Agricultural prices have been revised marginally lower on signs of adequate harvests in major producers, and are expected to register a decline of 4 percent from last year. Looking to 2017, a modest price recovery is projected for most commodities as demand strengthens. Crude oil is projected to rise to $50/bbl as the market moves into balance. This issue of the Commodity Markets Outlook examines the implications of resource development in an era of lower commodity prices and concludes that ambitious improvements in governance and sounder macroeconomic policies are required to mitigate delays and risks.

Trends. Energy prices fell 21 percent in the first quarter of 2016 (Figure 1). Oil prices led the decline by dropping 22 percent owing to resilient non-OPEC oil production, expanding supplies from Iran, and weak seasonal demand. Natural gas and coal prices are down 15 and 3 percent, respectively, due to oversupply.

Oil prices rose from $25/bbl in mid-January to more than $40/bbl in mid-April due a number of supply issues, notably outages in Iraq and Nigeria. In addition, oil production in the U.S. fell in December, the first year-on-year drop in several years, and there are indications that output declines may accelerate during 2016. A proposal by key OPEC and nonOPEC producers to freeze production at January levels failed to materialize at the Doha meeting on April 17. Non-energy commodity prices fell 2 percent in the first quarter on persistently large inventories and ample supplies.

Metal prices declined on weakening growth prospects in China and increasing supplies. Cost reductions, largely stemming from lower energy prices, have delayed closures of higher-cost mines. On early indications of favorable harvests in major producers, agricultural commodity prices fell 1 percent, marking the eighth consecutive quarterly decline, though prices of some agricultural commodities reversed the downward trend in March/April. El Niño-related problems reduced production of a few commodities (for example, rice and palm oil), but the reductions were not large enough to materially affect the agricultural price index. Fertilizer prices fell 12 percent amid surplus production capacity and slower seasonal demand. Precious metals prices rose 6 percent in the quarter (the only index with a sizeable increase), on stronger investment demand amid growing concerns about global growth prospects.

Outlook and risks. All main commodity price indexes are expected to decline in 2016 due to persistently abundant supplies and, in the case of industrial commodities, weak growth prospects in emerging market and developing economies (EMDE). Energy prices are expected to fall 19 percent, with average oil prices projected at $41/bbl in 2016 (compared with $37/bbl in the January 2016 Commodity Markets Outlook). This implies marginally higher prices for the rest of the year as the oversupply in the oil market diminishes. The rebound in oil prices from the January lows will be weaker than previous recoveries (Figure 2). Downside risks to the energy price forecast include higher-than-expected output from OPEC producers and weaker global growth.

On the other hand, higher oil prices could result because of supply disruptions among key OPEC producers, stronger-than-expected demand, or an agreement by major oil producers to curtail supplies. Non-energy prices are expected to fall 5 percent in 2016, 1 percentage point lower than the January 2016 Commodity Markets Outlook forecast (Table 1). Metals prices are projected to decline 8 percent following last year’s 21 percent drop, due to weak demand prospects and new capacity coming on line. Downside price risks include a further slowdown in China, largerthan-expected production, and depreciation of currencies of key suppliers.

Agricultural prices have been revised lower, and are projected to decline 4 percent in 2016 with prices falling in most commodity groups. This agricultural price outlook reflects adequate supplies in anticipation of another favorable crop year for most grain and oilseed commodities. Agricultural commodity markets are also aided by lower energy costs and plateauing demand for biofuels. The largest price drop is for grains and beverages (-5 percent each) and oils and meals (-3 percent).

Other food items and agricultural raw material prices are expected to fall as well. Upside risks to agricultural price forecasts include the likely development of La Niña (unusually cold weather in the equatorial Eastern Central Pacific Ocean). Its overall impact on commodity markets—if it materializes—will be less than the impact of El Niño. Downside risks reflect policies favoring support to agricultural commodity producers. Fertilizer prices could retreat as much as 13 percent in 2016 due to surplus capacity and weak demand. Precious metal prices are projected to fall 2 percent.

Special Focus on resource development in an era of low commodity prices. During the commodities super cycle that began in the early 2000s, many resource-rich countries benefitted from surging exploration, investment, and production activities, which transformed growth prospects. In 2016, with oil and metals prices 50-70 percent below their early-2011 peaks, these patterns have been reversed, adversely affecting many commodity-exporting countries.

Project development has already been put on hold or delayed in several emerging and developing countries. It would take ambitious governance improvements in EMDEs (e.g., to the levels prevailing in advanced markets) to mitigate the delays in ongoing development of large mines resulting from falling metals prices (up to four years for some of the largest mines in EMDEs). Governments seeking to newly develop natural resources may consider delaying new initiatives until the price outlook turns more favorable.

Source: worldbank.org