Heightened tensions in the Middle East have been exerting upward pressure on prices for key commodities, notably oil and gold. Copper prices have also reached a two-year peak, reflecting supply concerns and signs of firmer global industrial production. In 2024 and 2025, overall commodity prices are forecast to decline slightly but remain about 38 percent above pre-pandemic levels. Unlike prices for most other commodities, oil prices are set to increase in 2024, by 2 percent. Gold and copper prices are also set to rise this year, by 8 percent and 5 percent, respectively. In all, disinflationary tailwinds from moderating commodity prices appear essentially over. The persistence of high commodity prices, relative to pre-pandemic levels, despite subdued global GDP growth indicates several forces at play: geopolitical tensions are pushing up prices, investments related to the clean-energy transition are bolstering demand for metals, and China’s rising industrial and infrastructure investment is partly offsetting weakness in its property sector. Risks to the price forecasts are tilted to the upside, with the primary risk arising from a broadening of the conflict in the Middle East. A conflict-driven rise in commodity prices could stoke stubbornly elevated global inflation, further delaying global monetary easing. Food insecurity, which worsened markedly last year reflecting armed conflicts and elevated food prices, could also rise further.

The state of commodity markets

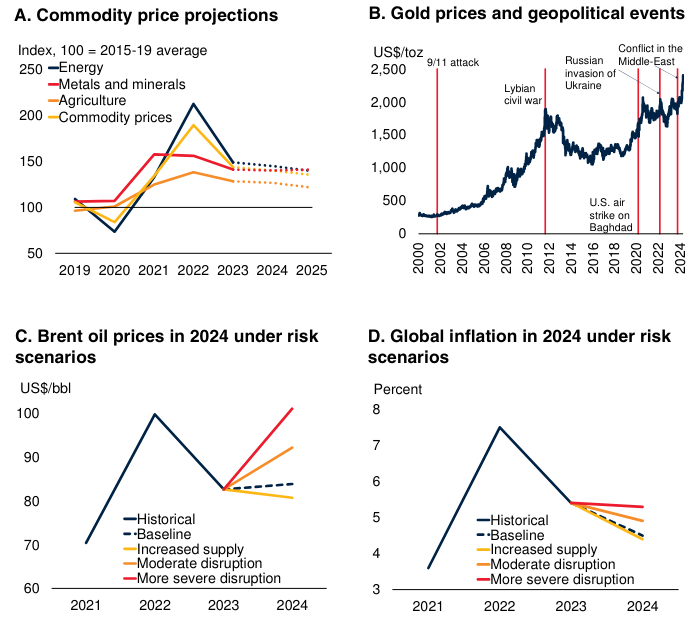

Heightened geopolitical tensions in recent weeks have been exerting substantial upward pressure on the prices of key commodities. In early April, the price of Brent oil reached $91 per barrel (bbl), $34/bbl above its 2015-19 average. Gold prices extended a three-year surge, reaching all-time highs amid safe-haven flows. Meanwhile, signs of resilience in global economic activity have also supported prices of other commodities—including copper, which recently climbed to a two-year peak. These price increases followed notable fluctuations in oil prices and, more generally, a plateauing of many commodity prices in the first quarter of the year (figure 1.A). Questions abound as to whether commodity prices—particularly oil prices—will continue to climb given heightened concerns of a regional escalation of the Middle East conflict, with potentially consequential implications for global inflation. The World Bank commodity price index is expected to decline marginally this year and next, while remaining considerably above its prepandemic levels. That said, there are several upside risks to these projections, particularly concerning the effects of further conflict escalation on energy supplies.

Over the next couple of years, the outlook is for sustained higher commodity prices relative to the half-decade before the COVID-19 pandemic, despite weaker global GDP growth (figure 1.B). The persistence of high commodity prices in a context of subdued global growth likely reflects several forces at play:

• Geopolitical tensions. Heightened geopolitical tensions are keeping upward pressure on prices of critical commodities and stoking risks of large price spikes (figure 1.C).

• Supply conditions. Given tight supply conditions for many industrial commodities, moderate upside surprises to economic activity may lead to notable price shifts. Signs of modest near-term firming in industrial demand have accompanied recent price increases (figure 1.D).

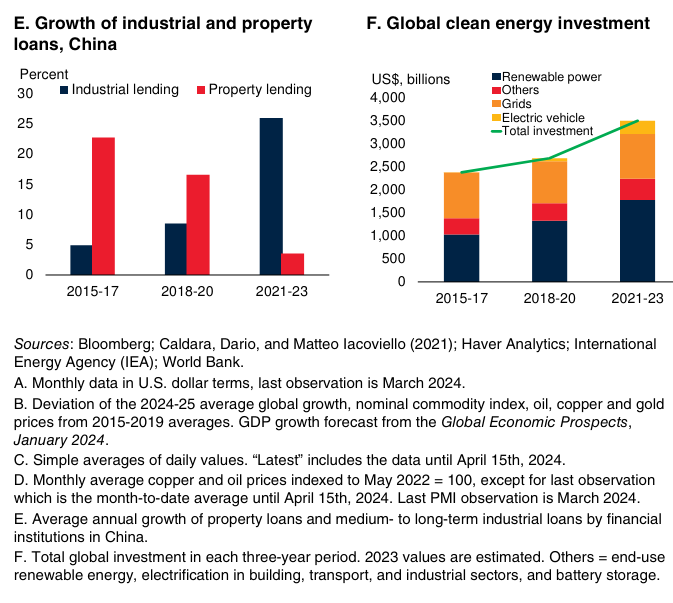

• China. The decline in property investment in China has not hurt commodity demand to the extent that many expected, especially for metals. In part, this reflects a concomitant rise in China’s investment in infrastructure and manufacturing capacity (figure 1.E).

• Climate change. The fight against climate change provides an increasingly important backdrop. Metals-intensive investment in clean energy technologies is growing at double-digit rates, creating a sustained tailwind for base metals prices (figure 1.F).

FIGURE 1 The state of commodity markets

Recent increases in the prices of some commodities followed notable fluctuations in oil prices and, more generally, a plateauing of many commodity prices in 2024Q1. Commodity prices are projected to remain well above pre-pandemic levels, despite notably slower global GDP growth. Heightened geopolitical tensions have been exerting upward price pressures, as have recent signs of firming manufacturing activity. In China, expanding industrial capacity and infrastructure investment is partially offsetting weaker commodity demand due to the property sector slowdown. Rising metals-intensive investment in the clean energy transition is providing a tailwind for base metals prices.

Outlook for commodity prices

The World Bank commodity price index is projected to decline by 3 percent in 2024 and 4 percent (y/y) in 2025 (figure 2.A).1 Although commodity prices are set to soften somewhat, they are expected to remain about 38 percent above 2015-19 average levels.

A relatively stable baseline forecast for many prices suggests tightly balanced markets. Commodity supply is generally set to improve, but commodity demand is also expected to pick up—even against a backdrop of still subdued global GDP growth— because industrial activity and trade growth are set to firm after stagnating in 2023. In part, this reflects expectations for broad, albeit measured, global monetary easing. In China, demand for energy and base metals is supported by expanding investment in infrastructure and preferred industries—including renewable energy, electronics, and electric vehicles—even as the property sector continues to soften. More broadly, continued efforts to reduce global carbon emissions portend accelerating demand for various metals and minerals that are crucial to the energy transition.

Energy prices

The energy price index is expected to edge down 3 percent (y/y) in 2024 and ease a further 4 percent in 2025. This trajectory is predicated on significant declines in coal and natural gas prices this year. In contrast, oil prices are projected to increase this year, with the Brent crude price averaging $84/bbl in 2024, up from $83/bbl last year, reflecting the recent ratcheting up of geopolitical tensions and a tight supply-demand balance. This forecast assumes no further conflict escalation and thus anticipates that the average oil price for the remainder of 2024 will edge down from early April levels, as the recent risk premium increase abates. Next year, oil prices are expected to trend somewhat lower, averaging $79/bbl as supply conditions improve.

Oil production is expected to expand 0.8 mb/d this year, due mainly to increasing supply from the United States, while OPEC+ production is set to decrease. Consumption is foreseen increasing about 1.2 mb/d this year—a notable deceleration from 2023—with all the net demand growth in emerging market and developing economies (EMDEs). Next year, oil demand growth is anticipated to slow further, with a contemporaneous reversal of OPEC+ supply reductions pushing production higher, resulting in building inventories.

Benchmark European natural gas prices are forecast to tumble 28 percent in 2024, due primarily to elevated inventories, before rebounding somewhat in 2025. U.S. natural gas prices are set to decline in 2024 before climbing sharply in 2025 as new LNG terminals facilitate increased exports. Coal prices are forecast to fall significantly in 2024-25.

Agricultural and metal prices

Non-energy commodity prices are forecast to dip 2 percent (y/y) in 2024 and an additional 3 percent in 2025. Agricultural prices are expected to soften this year and next, reflecting increased supplies and moderating El Niño conditions, primarily affecting food crops. Accordingly, food commodity prices are set to decline by 6 percent in 2024 and 4 percent in 2025, while a spike in beverage prices this year—reflecting supply constraints on Robusta coffee and, even more so, cocoa—is projected to partially retreat in 2025. Prices of agricultural raw materials, in contrast, are anticipated to remain stable. Fertilizer prices will likely continue a sharp descent, driven by lower costs for inputs such as natural gas.

The metals price index is expected to see little change in 2024-25. Base metal prices are forecast to edge up in both years and remain well above 2015-19 levels, reflecting a pick-up in global industrial activity and growing production of clean energy technologies. In contrast, a further decline is projected in the price of iron ore, which is important for property starts, but less relevant to the green transition.

Gold prices, which dominate the precious metals index, are assumed to plateau at their recent record highs for the rest of this year, resulting in an 8 percent rise in the annual average price in 2024. Gold holds a special status among financial assets, often rising in price during periods of elevated geopolitical and policy uncertainty, including conflicts (figure 2.B). Such safe-haven demand looks set to strengthen in 2024. Prices have also been supported by strong demand, partly reflecting the reserves management strategies of several EMDE central banks. Gold prices are set to dip slightly next year but remain historically high, averaging 62 percent above 2015-19 levels.

Key risks to commodity prices

Risks to commodity prices remain tilted to the upside. The key upside risk relates to further escalation of the conflict in the Middle East, particularly if this leads to substantial disruptions to energy supply. Such disruptions could drive aggregate commodity prices materially higher, given the importance of energy in the production and transport of other commodities. Lower-thanexpected U.S. energy production and weatherrelated disruptions globally could also exert upward commodity price pressures. Key downside risks include a faster unwind of OPEC+ supply reductions as well as weaker-than-expected global growth.

Upside risks

Further conflict escalation.

Energy markets, especially for oil, are susceptible to the evolving circumstances of the conflict in the Middle East. Given elevated uncertainty following the recent increase in regional tensions, a range of adverse outcomes remains possible. Further conflict escalation involving one or more key oil producers could result in extraction and exports in the region being curtailed, rapidly lessening global oil supply. The extent and duration of the impact on oil prices would depend on the scale of the initial shock, as well as the speed and size of the response of other producers to higher prices. Indicatively, however:

• A moderate conflict-driven disruption could initially reduce supply by about 1 mb/d. In a context of already tight markets, average prices in 2024 could rise by $8/bbl, to $92/bbl, nearly 10 percent above the baseline forecast (figure 2.C).

FIGURE 2 Commodity price outlook and risks

Commodity prices are forecast to decline slightly, on average, in 2024 and 2025, though oil prices are set to increase this year. Gold prices have surged to record highs on the back of safe-haven flows and central bank buying. Conflict-driven supply disruptions could push average Brent oil prices up sharply, though an earlier-than-expected unwind of OPEC+ supply cuts could see average prices dip below forecasts. Higher-than expected oil prices could stoke stubbornly elevated global inflation.

Sources: Bloomberg; Oxford Economics; World Bank. A. Commodity prices refers to the World Bank commodity price index, excluding precious metals. Dashed lines indicate forecasts. B. Daily data, last observation is April 17, 2024. Red vertical lines indicate adverse geopolitical events. C.D. The blue dashed lines indicate baseline forecasts for the price of Brent oil (panel C), and global consumer price inflation weighted by GDP (panel D). Oil prices and inflation are depicted as annual average values. The red, orange, and yellow lines indicate the possible ranges for the Brent oil price and global consumer price inflation in 2024 under different scenarios. The yellow line reflects a scenario in which OPEC+ production cuts are reduced sooner than in the baseline. The orange and red lines depict outcomes under moderate and more severe conflict-related disruptions to oil supply, respectively. D. Model-based GDP-weighted projections of annual average country-level CPI inflation using Oxford Economics’ Global Economic Model, with oil prices as described in risk scenarios.

• A more severe disruption, involving substantial reductions in the production or export capacity of one or more oil producers, could initially lower supply by about 3 mb/d. With other oil exporters likely to expand output in response, the envisaged supply reduction declines to 1 mb/d by late 2024. In such circumstances, average oil prices could hit $102/bbl in 2024, more than 20 percent above the baseline forecast.

Escalation of the conflict in the Middle East could also drive up prices for natural gas, food, and fertilizers. The region is a crucial gas supplier—20 percent of global LNG trade transits the Strait of Hormuz. Should gas supply be interrupted, fertilizer prices could in turn rise substantially, likely also leading to higher food prices. More broadly, the confluence of geopolitical tensions and ongoing conflicts, including Russia’s invasion of Ukraine, could adversely affect staple food supplies. Intensified attacks on Ukraine’s export facilities could reduce grain supplies, while further aggression toward ships in the Red Sea could force more Black Sea origin vessels to reroute, elongating dry bulk supply routes.

Lower U.S. energy supply. In addition to the potential for a conflict-driven supply shock, prices for oil and natural gas could turn out higher if U.S. energy production falls short of the expansion assumed in the baseline. U.S. oil production has stagnated recently in a context of elevated input costs. Moreover, rapid expansion of U.S. LNG terminals in 2024-25 might not proceed as planned, reducing LNG supplies.

Weather- and climate-related disruptions. Unexpected weather patterns could result in weather-related disruptions to commodity markets, leading to higher prices. Growing seasons could be compromised, leading to price spikes for agricultural commodities. Cold temperatures in major gas-consuming regions would raise natural gas prices. In addition, spells of unusually dry weather—increasingly common, given climate change—could adversely affect hydropower production, resulting in higher coal and natural gas prices.

Downside risks

Higher OPEC+ oil supply.

Oil prices could be driven lower by upside surprises to production. The baseline forecast is predicated on OPEC+ production cuts being maintained until next year. It is possible, however, that OPEC+ could reverse supply reductions in the second half of 2024. In that case, 1 mb/d could be returned to the market, augmenting the increase in non-OPEC+ output already assumed in the forecast. Prices could accordingly turn out lower, averaging about $81/ bbl in 2024, 4 percent below the baseline.

Weaker global growth.

Demand for commodities could prove weaker than expected—resulting in price declines—if global growth is slower than assumed. This could be the case if elevated core inflation proves persistent, leading major central banks to delay interest rate cuts, or if latent financial vulnerabilities emerge, resulting in tighter global financial conditions. Intensifying economic challenges in China, in particular, could pose sizable downside risks to energy and metals prices.

Key broader implications

Prospective and potential developments in commodity markets have critical implications for key challenges in the global economy, including inflation and food security.

Inflation and monetary policy.

Declining commodity prices were critical to broad-based disinflation in 2023. Commodity prices plunged nearly 40 percent between June 2022 and June 2023, driving a more than 2-percentage-point reduction in global inflation between 2022 and 2023.2 Those disinflationary tailwinds appear essentially over—the World Bank commodity index is close to unchanged from twelve months ago. The marginal softening of average commodity prices forecast for this year will do little to subdue inflation that remains above targets in many economies.

Moreover, risks of higher commodity prices could materialize, posing a renewed source of inflationary pressure. If conflict-related disruptions push this year’s average Brent oil price to $102/bbl, as discussed by the more severe scenario above, global consumer price inflation could be 0.8 percentage point higher than the baseline projection in 2024 (figure 2.D). Central banks may be less inclined to look through a rise in noncore prices than in the past, reflecting concerns that, in the presence of heightened geopolitical tensions, elevated energy inflation could feed through to wider prices and inflation expectations. Monetary policy easing could therefore be delayed.

Food inflation and insecurity.

Global food price inflation decreased to 4.9 percent in 2024Q1 from 5.7 percent in 2023Q4, partly attributed to declining international prices of agricultural commodities. However, about one in five emerging market and developing economies experienced higher food inflation in 2024Q1 than in 2022—the peak year of the recent global inflation surge. Food inflation exceeded 5 percent in half of countries in each of the Middle East and North Africa, Latin America and the Caribbean, South Asia, and Sub-Saharan Africa regions.

After doubling between 2018 and 2022, acute food insecurity worsened further last year, despite moderating food inflation. The latest data for 48 highly food-insecure countries indicate a 10- percent increase in acute food insecurity in 2023. While elevated commodity prices are a crucial factor, armed conflict is often the primary driver of food crises. The global rise in conflict and instability—including conflicts in the Middle East and Sub-Saharan Africa, as well as Russia’s invasion of Ukraine—has substantially exacerbated food insecurity. If conflicts escalate further, global hunger could rise substantially.

Special Focus

Forecasting Industrial Commodity Prices: An Assessment

The Special Focus of this edition evaluates the performance of five well-known approaches to forecasting the prices of three key industrial commodities—aluminum, copper, and crude oil—over the period 2015Q1 to 2022Q1. High short-term volatility and significant longer-term movements in commodity prices—both features of commodity markets in recent years—present major challenges for policymakers in commodityexporting EMDEs. Such challenges are easier to meet the more accurately price changes can be forecast. The evaluation reveals four main results. First, there is no “one-approach-beats-all” for commodity price forecasting, as the forecast accuracy of approaches varies significantly across commodities and time horizons. Second, macroeconometric models tend to be more accurate at longer horizons, partly because they can incorporate the effects of structural changes on prices. Third, it is critical to complement forecasts by incorporating judgment (information that cannot be accounted for by statistical approaches), especially when confronted by unusual or unprecedented events. Finally, these results underscore the value of employing a range of approaches in forecasting commodity prices.

Source: worldbank.org