The latest conflict in the Middle East has introduced significant uncertainty into commodity markets that have been coping with the effects of an extraordinary series of shocks in recent years. Before the conflict began, voluntary oil supply withdrawals by OPEC+ producers pushed energy prices up 9 percent in the third quarter. As a result, the World Bank’s commodity price index rose 5 percent over that period and is now 45 percent above its 2015-19 average. For now, the impact of the conflict on commodity prices has been muted. Prices of oil and gold have risen moderately, but most other commodity prices have remained relatively stable. Nevertheless, history suggests that an escalation of the conflict represents a major risk that could lead to surging prices of oil and other commodities—an outcome that would intensify food insecurity in the region and across the world. This report includes a Special Focus section that provides a preliminary assessment of the potential impact of the conflict on commodity prices. It finds that the effects of the conflict are likely to be limited, assuming it does not widen. Under that assumption, the baseline forecast calls for commodity prices to decline slightly over the next two years. If the conflict does escalate, the assessment also includes what might happen under three risk scenarios, relying upon historical precedents to estimate the effects of small, moderate, and large disruptions to the global oil supply. The magnitude of the effects will depend on the duration and scale of the supply disruptions. Trade restrictions and weather-related disruptions could also result in higher prices; conversely, weaker-than-expected global growth represents a key downside risk to commodity prices.

Recent developments

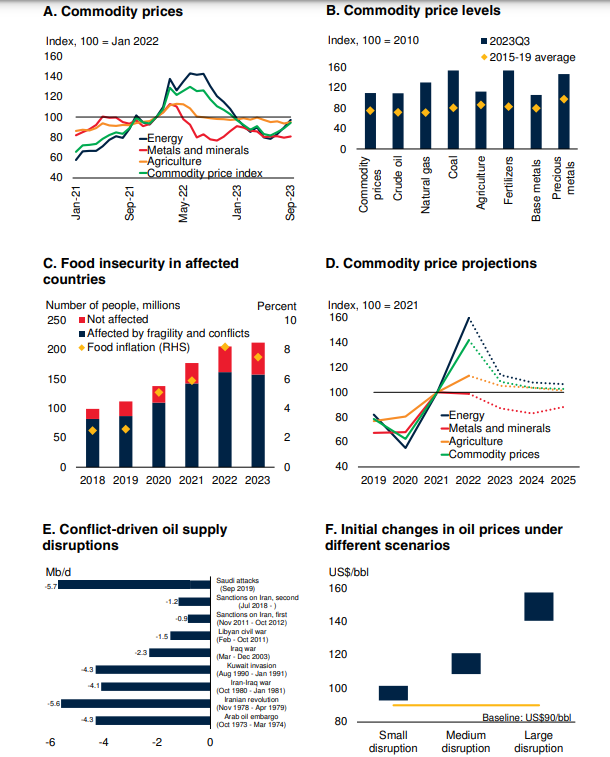

The latest conflict in the Middle East has raised geopolitical risks for commodity markets. So far, its impact on prices has been small. However, previous military conflicts in the region often resulted in higher prices and volatility in commodity markets. This suggests that an escalation of the conflict could trigger sharp oil supply disruptions, depending on the duration and scale of the escalation (see Special Focus). In the third quarter, before the latest conflict, the World Bank commodity price index rose 5 percent over the previous quarter, driven mainly by an 11 percent surge in oil prices. Because oil accounts for 52 percent of the index, this more than offset price declines in 24 of the 43 commodities in the index. The increase occurred against the backdrop of a notable fall in prices the previous year (figure 1.A). Stronger-than-expected activity in the third quarter supported oil prices, complemented by a series of supply cuts by the Organization of Petroleum Exporting Countries and 10 affiliated member countries (OPEC+), pushing prices up. Non-energy prices fell by 2 percent amid plentiful supplies, particularly of grains and base metals. Overall, before the conflict in the Middle East, commodity prices remained relatively high, about 45 percent above the 2015- 2019 average in nominal terms and 25 percent in inflation-adjusted terms (figure 1.B).

Energy prices have often registered substantial volatility following previous episodes of military conflict in the Middle East. Since the beginning of the latest conflict, overall energy prices have increased by 9 percent. Oil prices have risen 6 percent amid uncertainty about the impact of the conflict on supply. European natural gas prices have risen since September due to ongoing labor strikes at Australian LNG facilities. They surged by an additional 35 percent after the shutdown of a gas field off the Israeli coast, an explosion at an interconnector in the Baltic Sea, and concerns about the escalation of the conflict in the Middle East. Energy prices rose by 9 percent in 2023Q3 (q/q). Waning concerns about banking stress in advanced economies, coupled with better-thanexpected global activity—as air travel and transport rebounded—supported oil prices above $70/bbl. In addition, resilient consumption growth in China offset the continued weakness in the country’s real estate sector. Global oil demand is estimated to have reached a record 103 million barrels per day (mb/d) in 2023Q3 (IEA 2023a).

Commodity prices, outlook, and risks

Prior to the latest conflict in the Middle East, commodity prices rose in 2023 Q3 led by energy. They remain only slightly below levels just before the Russian invasion of Ukraine and well above pre-COVID levels. Though food inflation worldwide is trending down, food insecurity remains a concern, especially for those living in fragile and conflict situations. Commodity prices are set to fall gradually in 2024 and stabilize in 2025. As suggested by historical precedents of conflict-driven oil supply disruptions, an escalation of the latest episode represents a major upside risk to the price forecasts, depending on the duration and scale of the supply disruption.

FIGURE 1

On the supply side, production cuts by OPEC+ helped raise prices above $90/bbl in September. Saudi Arabia’s 9 mb/d crude output for the rest of 2023 is 2 mb/d lower than in September 2022 and the lowest in more than a decade outside of recessions. Nevertheless, production outside of OPEC+ in 2023 has been robust, and the group’s announced reduction has been roughly offset by production increases in the Americas, led by the United States, the world’s largest producer. The EU has replaced lost Russian pipeline gas with liquefied natural gas (LNG) imports and higher piped gas from Norway and North Africa. Lower natural gas demand in Europe has been driven by efficiency gains, policies to administer demand, and weaker production in the industrial sector. Slower-than-expected imports into China have also relieved pressure on natural gas prices. This has allowed EU natural gas inventories to reach 95 percent of full capacity ahead of winter. Despite these developments, European natural gas prices remain 82 percent above their 2015-19 average. Coal prices continued to decline on improved supply and greater substitution to cleaner fuels in power generation. Fertilizer prices rose slightly, though the fertilizer affordability index is almost at pre-2022 levels. Still, the fertilizer price index remained 85 percent above 2015-19 average levels. Prior to the latest conflict in the Middle East, agricultural commodity prices fell 3 percent in the third quarter, mainly driven by declines in the price of food (the index’s main component). The food price index fell by 3 percent, led by a 7 percent drop in grains. The non-renewal of the Black Sea Grain Initiative, India’s export ban of non-basmati rice, and the impending El Niño drove volatility in agricultural prices, but ample supplies kept prices on a mild downward trend. Agricultural prices have risen since September and ticked up almost 4 percent since the beginning of the conflict. Domestic food inflation has moderated but remains at double-digits in four out of ten low-income countries and a third of middle- and high-income countries, adding to the burden of food insecurity in many parts of the world.

Food insecurity has been rising for several years, and as of August of this year affected over 210 million people living in countries facing conflict and violence (figure 1.C). Stretched resources have hampered food distribution by aid agencies as they respond to several conflicts and disasters, including Afghanistan, the Middle East, SubSaharan Africa, and Ukraine (WFP 2023). In particular, the latest conflict in the Middle East has exacerbated food insecurity in the region as 53 percent of the population in Gaza was already facing insecurity prior to the conflict. Beyond its direct impact on the affected populations, an escalation could worsen food insecurity at the global level, particularly if food prices jump and funds for food distribution are further stretched.

Metal prices have edged down 1 percent since the onset of the conflict. However, gold prices— which usually move in tandem with geopolitical concerns—have increased 8 percent. An escalation of the conflict would push metal prices up, mainly through indirect channels. Prolonged disruptions to energy markets can raise production costs of energy-intensive metals such as aluminum and zinc. Heightened geopolitical risk could lead to much higher gold prices, as investors shift to safehaven assets. Before the conflict in the Middle East, metal prices fell 2 percent in the third quarter. Weighing on prices was continued weakness in China’s heavy industry sector and housing construction, offsetting resilient demand in the manufacturing of metals-intensive renewable energy products. Globally, elevated interest rates have weighed on construction and investment, contributing to weaker metals demand amid plentiful supplies. Gold prices also fell 3 percent last quarter because of a stronger U.S. dollar and concerns about higher for longer interest rates. Prices for minerals used in electric vehicles and battery production, such as cobalt, lithium, and molybdenum, have followed the downward trend in base metals prices. However, prices remain volatile due to the stratified and concentrated nature of mineral markets.

Outlook

The baseline forecasts assume that the latest conflict will have a limited impact on commodity prices, with prices ultimately being driven by fundamental demand and supply factors. Under the baseline forecast, after a projected 24 percent drop this year, commodity prices are expected to fall a further 4 percent in 2024 and 0.5 percent in 2025 (table 1). A key driver of the continued weakness in commodity prices in 2024 is weak global growth amid tight financial conditions. Subdued global goods trade and weakness in China’s highly leveraged property sector will also weigh on energy and industrial metals into 2024. Increased supply of major commodities (crude oil, grains, metals, and most food commodities) will also dampen prices (figure 1.D). Critically, this forecast assumes that the latest conflict will remain contained, with minimal effects on commodity markets. Firming global growth, along with policies to expand renewable energy infrastructure, are expected to underpin a rebound in commodity prices in 2025. Global investment in clean energy infrastructure is estimated to have increased by almost 40 percent between 2020 and 2023 and is rising rapidly, propelling a demand surge for copper, lithium, and nickel, in particular.

Energy prices, after dropping by an estimated 29 percent in 2023, are expected to fall 5 percent in 2024 as subdued global growth reduces demand pressure. They are then projected to edge further down 0.7 percent in 2025. The Brent crude oil price forecast for this year has not changed since the April edition of the Commodity Markets Outlook and is expected to average $84/bbl for 2023, which implies that prices will average almost $90/bbl in the last quarter. Continued concerns about the conflict in the Middle East and other geopolitical risks, the contraction of OPEC+ supply, and pressures from middle-distillate demand are also expected to support prices in the last quarter. However, these forecasts as a whole highlight the expectation that the conflict will have a limited impact—assuming it does not escalate into a wider conflict. The forecast also assumes that global oil production will increase within and outside OPEC+, provided that some OPEC+ supply cuts are reversed in early 2024. Following a record plunge in European natural gas prices earlier in 2023, natural gas prices are projected to decline 4 percent in 2024 on slower demand. The forecast assumes relatively mild weather in the Northern Hemisphere and no disruption in supplies. Coal prices are envisaged to continue a downward trend on rising supply and weakening demand as coal consumption continues to be displaced in power generation and industry.

Agricultural prices are forecast to fall by 7 percent in 2023 and a further 2 percent in 2024 and 2025 owing to ample supplies. Food and beverage prices will decline slightly more, while agricultural raw materials will rise by over 1 percent. Following a more than 11 percent fall in 2023, the grains price index is projected to fall by 4 percent on average in 2024 and 2025 amid ample supplies and adequate stock levels. However, rice prices will remain high into 2024, assuming India maintains its export restrictions. The outlook assumes a moderate-to-strong El Niño. Sugar and cocoa prices are expected to decline from 2023 highs, though fruit prices should remain high in 2024 on weather-affected supply shortfalls. Fertilizer prices are expected to decrease as more supplies come online, but they are likely to stay above historical averages due to some supply constraints and China’s ongoing fertilizer export restrictions.

Base metal prices are projected to fall 5 percent in 2024 due to slowing demand and rebound in 2025 on recovering global industrial activity. Even though activity in China’s property and construction sectors is anticipated to stabilize by 2024, these sectors will increasingly have less influence on global metals demand than they did in the previous two decades.

Risks

Geopolitical risks have sharply increased in the wake of the latest conflict in the Middle East and constitute the most important upside risk to commodity prices. If the conflict intensifies and becomes a wider regional conflict, the impact on commodity markets could be significant. Historical precedent indicates that, depending on the duration and scale of an escalation of the conflict, substantial supply disruptions and soaring prices are possible (figure 1.E).

The Special Focus presents three risk scenarios that are contingent on the severity of the impact of an escalation of the conflict on oil supply. Each scenario considers a range of possible initial supply declines in light of earlier episodes and presents a corresponding range for the initial impact on prices (figure 1.F). In a small disruption scenario, global oil supply would be reduced by 0.5 mb/d to 2 mb/d (0.5 and 2 percent of 2023 supply). As a result, oil prices would initially increase by 3 to 13 percent above the 2023Q4 baseline forecast of $90/bbl. In a medium disruption scenario, global oil supply is reduced by 3 to 5 mb/d (approximately 3 to 5 percent of 2023 supply). This would push oil prices about 21 to 35 percent above the baseline forecast in 2023Q4. Finally, in a large disruption scenario, global oil supply would fall by 6 to 8 mb/d (approximately 6 to 8 percent of 2023 supply). This would push oil prices about 56 to 75 percent above the 2023Q4 baseline.

These types of disruptions in oil supplies can have a cascading impact on the prices of other commodities—especially natural gas prices, which are even more susceptible to transportation disruptions than oil. Beyond the impacts on energy prices, they would also push up prices of metal and agricultural commodities for the reasons mentioned earlier. These scenarios refer to the initial impacts of an escalation, whereas forecasts for oil and other commodity prices shown in this report refer to annual prices. Ultimately, the impact of any of these scenarios, should they materialize, on annual prices will greatly depend on the duration and scale of the underlying shock to commodity markets.

Other geopolitical risks, additional trade restrictions, and continuation of production cuts by OPEC+ into 2024 also cloud the outlook. The cessation of the Black Sea Grain Initiative has limited the scope for Ukrainian grain and oilseed exports, and further disruptions to bulk transport and power distribution could push food and energy prices higher. Moreover, export restrictions on certain commodities could lead to price spikes. Geopolitical motives for securing supplies of critical minerals from major consumers are already high, and the number of restrictive trade interventions in metals and minerals has increased by more than four times as of end-2022 compared to the average number in 2015-19. Trade fragmentation would make low-income countries particularly vulnerable, given their high dependence on imports of agricultural goods (IMF 2023a).

Severe weather events primarily driven by El Niño over the next six months, such as floods, could impact both agriculture and metal mining production, as evidenced by recent episodes in Chile and Peru, and push up prices. There have also been floods at Australian ports and coal mines, which damaged transport infrastructure. Some areas will experience drier weather, so upside risks include the possible impact of heat waves and El Niño-induced droughts.

On the downside, weaker-than-expected global growth, particularly in manufacturing and trade, is a key downside risk. Tighter global financial conditions could further weigh on demand for commodities used in industry and construction and lead to lower industrial commodity prices.

Source: worldbank.org