Global commodity prices fell 14 percent in the first quarter of 2023, and by the end of March, they were roughly 30 percent below their historic peak in June 2022. The surge in prices after Russia’s invasion of Ukraine has largely been unwound on a combination of slowing economic activity, favorable winter weather, and a global reallocation of commodity trade flows. For the remainder of this year, commodity prices are forecast to remain broadly unchanged. However, prices are still expected to remain above pre-pandemic levels, which will continue to weigh on affordability and food security. Upside risks to prices include possible disruptions in the supply of energy and metals (in part due to trade restrictions), intensifying geopolitical tensions, a stronger-than-anticipated recovery in China’s industrial sector, and adverse weather events. Disappointing global growth is the major downside risk.

Recent developments

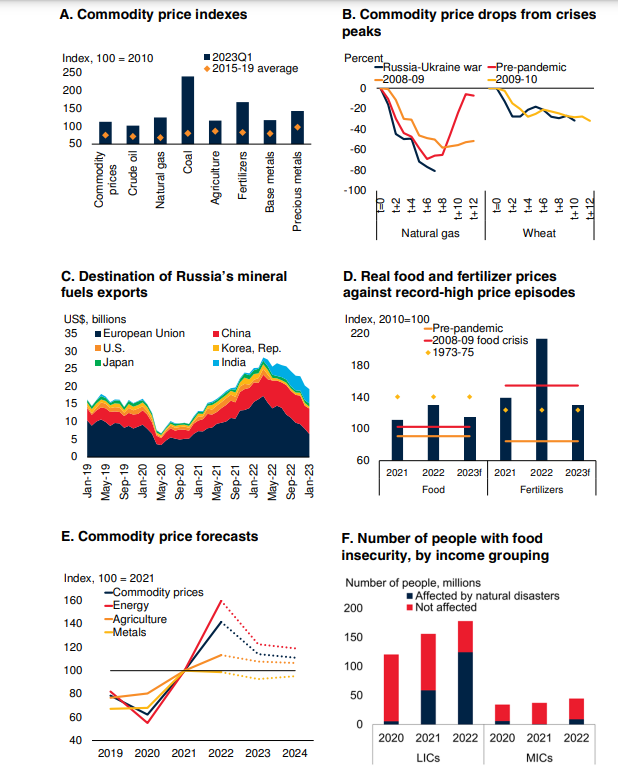

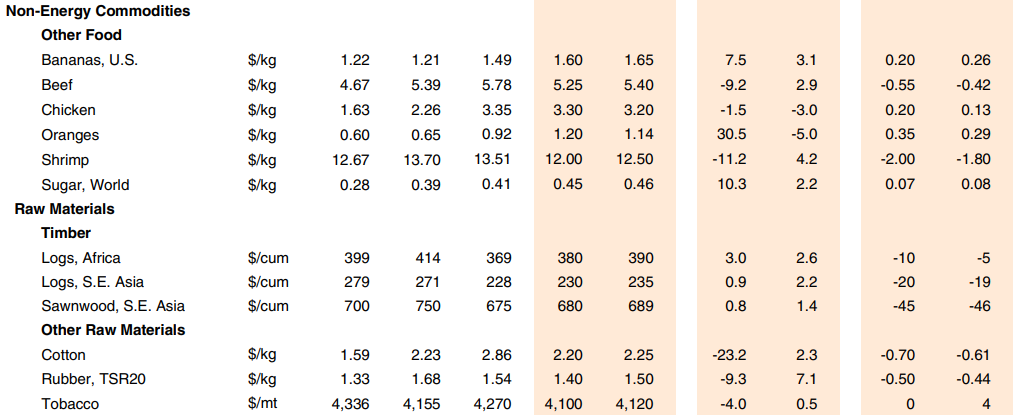

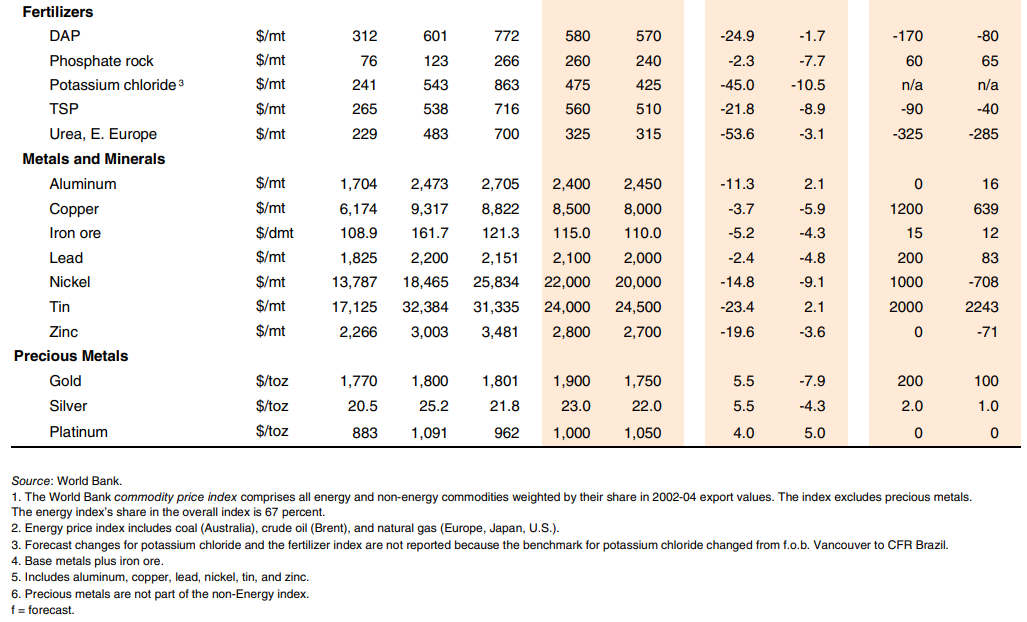

Commodity prices have declined sharply over the past six months, after many posted record-high levels last year. The World Bank commodity price index declined by 32 percent from its historic peak in June 2022, the sharpest drop since the COVID-19 pandemic started. As a result, the price surges that followed the Russian Federation’s invasion of Ukraine have largely been unwound due to a combination of slowing global economic activity, favorable winter weather, and the redirection of trade of key commodity exports from Russia and Ukraine. By March of this year, prices of wheat and natural gas have registered especially large drops from their peaks in May and August last year, respectively. Nonetheless, prices of all major commodity groups and about fourfifths of individual commodities remain above their 2015-19 average levels (figures 1.A and 1.B). Fertilizer prices reached an all-time high in real terms in 2022, while the food price index reached its second-highest level in real terms—behind the 1973-75 period of grain shortages.

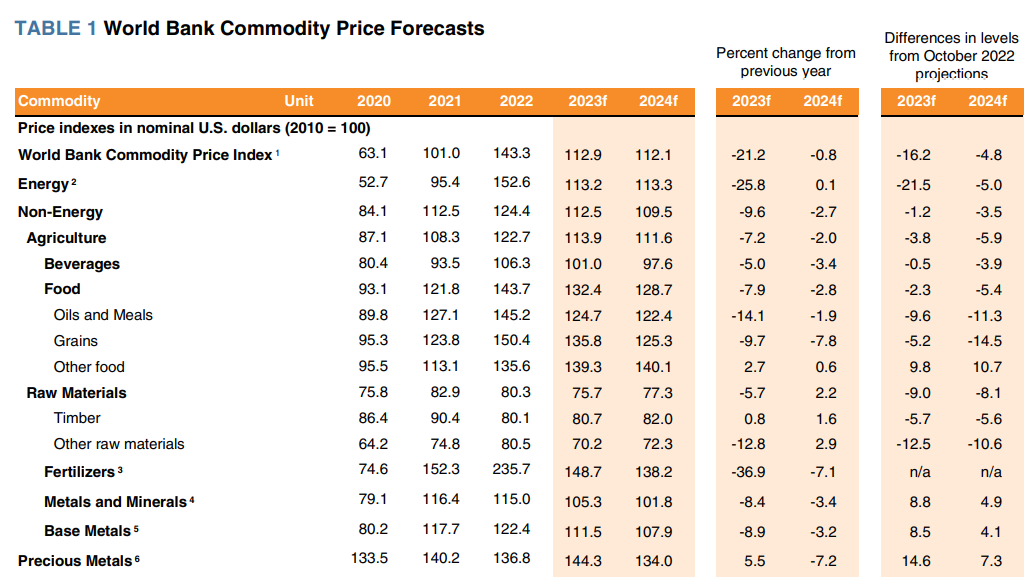

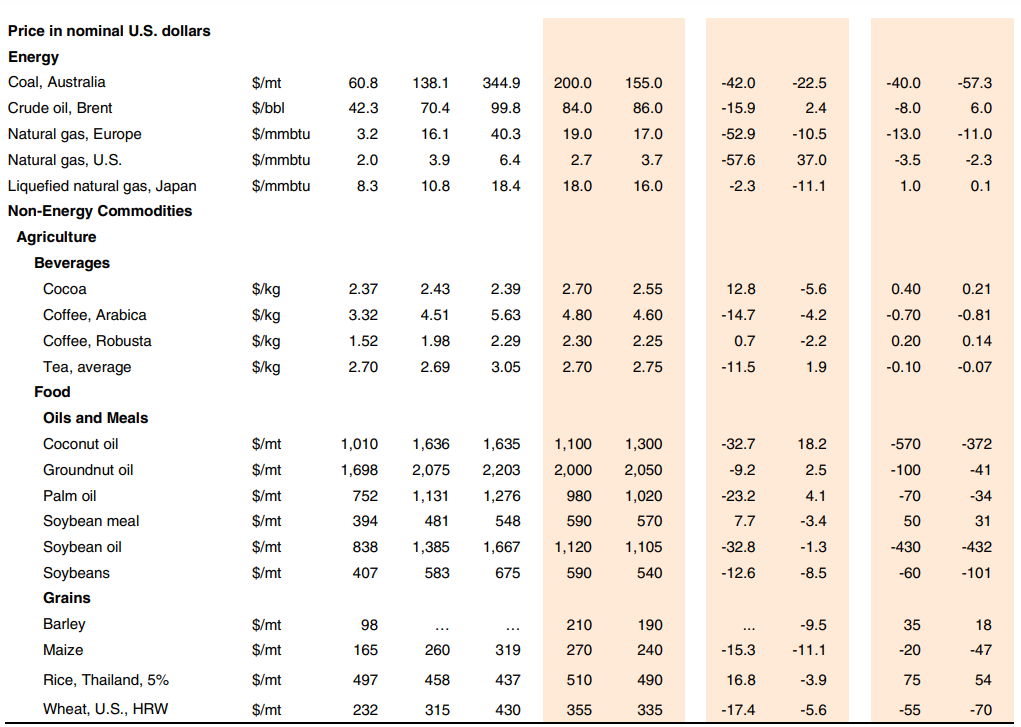

Energy prices were 20 percent lower in the first quarter of 2023 than in the final quarter of 2022. The Brent oil price is 35 percent below its recent record high in June 2022, despite experiencing volatility in March 2023. The discount on the benchmark price paid for Russian oil against the Brent price widened in December 2022 after the introduction of a price cap by the Group of Seven (G7) industrial countries. In Europe, milder-thanexpected winter weather, a surge in imports of liquefied natural gas (LNG), and a concerted effort to increase energy efficiency and conservation helped bring down natural gas prices by about 80 percent from their August peak. Larger export volumes and a redirection of trade routes have enabled both natural gas and coal markets to adjust to disruptions triggered by Russia’s invasion of Ukraine. Russia continues to redirect its mineral fuel exports from Europe to China, India, and other emerging markets and developing economies (EMDEs), as it has been doing since the start of the invasion (figure 1.C). The price of fertilizers, which use natural gas and coal as inputs, also declined sharply.

Agricultural prices were broadly unchanged between the final quarter of 2022 and the first quarter of 2023—at 14 percent below their April 2022 peaks. Renewal of the Black Sea Grain Initiative continued to help grain exports from Ukraine reach global markets. The initiative, better harvests in other major grain-producing countries, and lower energy prices, have helped reduce agricultural commodity prices from their early-2022 peaks. Grain prices fell 5 percent in the first quarter of 2023, while prices of most other food commodities rose slightly. In real terms, food prices continue to remain above levels observed during the 2007-08 food crisis (figure 1.D). Elevated food prices contribute to higher food insecurity, with severe implications for poorer populations in many developing economies. Annual domestic food price inflation across 146 countries averaged 20 percent in February 2023, the highest level over the past two decades. Of those, nine out of ten low- and middle-income countries face food price inflation above 5 percent.

FIGURE 1 Commodity prices and outlook

Commodity prices have declined from their record levels in 2022 but remain well above their pre-pandemic (2015-2019) average. Natural gas prices had historically large declines from their August 2022 peak and wheat prices had a similar decline from their May 2022 peak, both reflecting improved supply prospects and redirection of trade. Russia has been able to redirect its mineral fuel exports from Europe to China, India, and other EMDEs since February 2022. Food and fertilizer prices are still near their record levels, and are expected to remain high in real terms, reducing affordability for lower-income households. Commodity prices are expected to remain broadly unchanged over the remainder of 2023 and into 2024 amid improved supply prospects and weakening global demand

The metals and minerals price index rose 10 percent in the first quarter of 2023 from the final quarter of 2022. A short-lived price spike in January was fueled by expectations that the end of China’s zero COVID-19 policy would push demand higher, as China accounts for roughly half of the global consumption of base metals. However, prices declined in March, largely because of weakening global demand. The precious metals index increased by 9 percent in 2023Q1, driven by a weakening dollar, safe haven buying following banking stress in the United States and Europe, and strong industrial demand for platinum and silver.

Outlook

After rising by 45 percent in 2022, commodity prices are expected to fall by 21 percent this year and remain mostly stable in 2024. The expected decline in prices for 2023 as a whole represents the steepest decline since the pandemic. The decline in energy prices in the first quarter of 2023 is expected to fade and be followed by stable prices over the remainder of 2023 and a slight uptick in 2024, as markets are expected to tighten amid supply pressures. Non-energy commodity prices, in contrast, will decline by about 10 percent in 2023 and almost 3 percent in 2024 as global demand is proving to be weaker than initially expected in the October 2022 forecast (figure 1.E).

Energy price forecasts have been downgraded sharply. The energy price index is expected to fall by 26 percent in 2023 (much of that decline has already taken place) and remain broadly unchanged (up 0.1 percent) in 2024. Brent crude oil prices are forecast to average $84 per barrel in 2023. Weaker global demand has already caused them to drop 15 percent below the 2022 average, and they are projected to remain at that level through the end of 2024. Natural gas prices in Europe have fallen precipitously, with a 53 percent decline expected in 2023, but will remain almost three times as high as the average levels seen in 2015-19. Europe still faces challenges to ensure adequate supply next winter, among them increased competition for LNG exports from Asia.

Coal prices are forecast to fall 42 percent in 2023 and 23 percent in 2024. The anticipated increase in demand from China is likely to be offset by weaker demand elsewhere, as utilities switch back to natural gas. Exports from major producers (particularly Australia, and Indonesia) are anticipated to rise. Fertilizer prices are projected to fall by 37 percent in 2023 in tandem with expected declines in the prices of natural gas and coal, but in real terms remain near the high levels during the 2008-09 food crisis.

Agricultural prices are projected to decline 7 percent in 2023 and ease further in 2024. Food prices are expected to fall by 8 percent in 2023 and 3 percent in 2024, assuming that grain and oilseed exports from the Black Sea region will remain stable. Nevertheless, real food prices in 2023 will remain at their second highest levels since 1975—exceeded only by 2022 (figure 1.D). More than 349 million people globally are projected to face food insecurity this year—double the number in 2020—because of high food and fertilizer prices, conflicts, and economic and climate shocks (WFP 2023). The prevalence of natural disasters is associated with a significant increase in the number of food insecure households, particularly in low-income countries (figure 1.F). Prices for agricultural raw materials, which include cotton, timber, and rubber, will decline by about 6 percent in 2023, reflecting sluggish global industrial demand growth, and rebound by 2 percent in 2024 as China’s demand picks up.

Metals and minerals prices, which briefly increased in January 2023, are expected to fall by 8 percent in 2023 relative to last year and a further 3 percent in 2024. Global demand in manufacturing is expected to remain weak, and China’s recovery is expected to be heavily services-oriented (World Bank 2023a). Strong supply growth is projected over the forecast horizon, supported by a recovery from production outages and new mines coming on stream for key metals (copper, nickel, and zinc). Precious metals prices are expected to increase by 6 percent in 2023 as safe-haven demand rises amid elevated uncertainty with respect to future growth prospects, ongoing concerns about inflation, and financial stress in the first quarter.

Risks

Risks to the forecast are tilted to the upside, primarily because many of the factors underlying the shocks to commodity markets in recent times still prevail:

• Weaker-than-expected oil supply. Supply could disappoint both in Russia, especially if sanctions disrupt oil exports more than anticipated, and in other Organization of Petroleum Exporting Countries and 10 affiliated member countries (OPEC+), where supply remains below target—with many countries at or near full capacity. Tighter credit conditions may impede the ability of oil or coal companies to increase supply elsewhere. Policies to hasten the energy transition may discourage fossil fuel production, while also increasing demand for metals, particularly copper, nickel, and lithium. Fossil fuel energy producers may prefer to use profits to strengthen balance sheets and reward shareholders, rather than investing in expanding production. This would lead to higher prices of carbon-intensive energy commodities, but also metals and minerals.

• Direction of demand from China. The recovery in China may be tilted toward commodityintensive sectors, and not services (as forecast). This would lead to higher prices for energy and metals because of larger demand from industry. The real estate sector in China may begin to strengthen sooner than assumed, raising import demand and prices for base metals. This could result in upward pressure on prices of aluminum, copper, lithium, and nickel, which are anticipated to experience a surge in global demand over the medium term because of their usage in the manufacturing of electric vehicle batteries.

• Intensification of geopolitical tensions. Global supplies of grain and energy (particularly coal and natural gas) could change course unexpectedly if geopolitical tensions intensify. In the case of energy, European natural gas stocks are high but may not be sufficient to cover consumption in the 2023-24 winter months (European Commission 2023). Disruptions in trade routes—particularly for grains around the Black Sea and Ukraine—amid sanctions and counter-measures could raise grain prices. Against the backdrop of already elevated food prices, this could deepen food insecurity in many EMDEs.

• Unfavorable weather conditions. The occurrence of adverse weather events that affect crops in major global food-producing regions could result in an increase in food prices. Colder-than-usual winter weather or warmerthan-usual summer weather could raise heating or cooling demand for energy in the northern hemisphere. Adverse weather events could be driven by natural disasters that are happening more frequently as a result of climate change (IPCC 2023; World Bank 2020a). In addition, if an El Niño event happens, it could lead to higher temperatures and heavy rainfall later in 2023 (NOOA 2023).

The main downside risk is if prices of industrial commodities—energy and metals commodities— retreat if global activity ends up weaker than expected (World Bank 2023b). Continued elevated inflationary pressures could require an even more aggressive policy response from major central banks. Following the recent financial stress episode, credit conditions could tighten. If these types of risks occur, they would dampen demand for industrial commodities and lead to lower prices.

Special Focus: Forecasting Industrial Commodity Prices

The Special Focus (SF) of this edition assesses the performance of a wide range of approaches used to forecast prices of seven industrial commodities— oil and six industrial metals—by reviewing 60 studies published in academic journals. The studies evaluate the performance of models based on three criteria: (i) directional bias (whether forecast and actual prices move in the same direction); (ii) precision (measured as the root mean squared forecast error); and (iii) unbiasedness (whether the forecasts systematically over- or under-predict prices). The SF reports four key results. First, futures prices, which are widely used for price forecasts, often lead to large forecast errors. Second, multivariate time series models tend to outperform other model-based approaches. Third, early studies suggest that machine learning techniques yield better forecasts than some traditional approaches. Finally, augmenting model-based forecasting approaches, by incorporating the dynamics of commodity prices over time and controlling for other economic factors, enhances forecast accuracy.

Source: worldbank.org