Prices of industrial commodities continued to strengthen in the third quarter (q/q), while most agricultural prices remained broadly stable. In the oil market, inventories continue to fall amid strong demand, OPEC production restraint, and stabilizing U.S. shale oil production. Crude oil prices are expected to average $53 per barrel (bbl) in 2017 (up from $43/bbl in 2016) and rise to $56/bbl in 2018, a small downward revision from the April 2017 forecast. Metals prices are expected to surge 22 percent in 2017 due to strong demand and supply constraints, notably Chinese environmentally-driven supply cuts.

With the exception of iron ore, metals prices are expected to increase moderately in 2018. Agricultural prices are seen broadly unchanged in 2017 and are anticipated to gain marginally in 2018. Most food markets are well-supplied and the stocks-to-use ratios of some grains are forecast to reach multi-year highs.

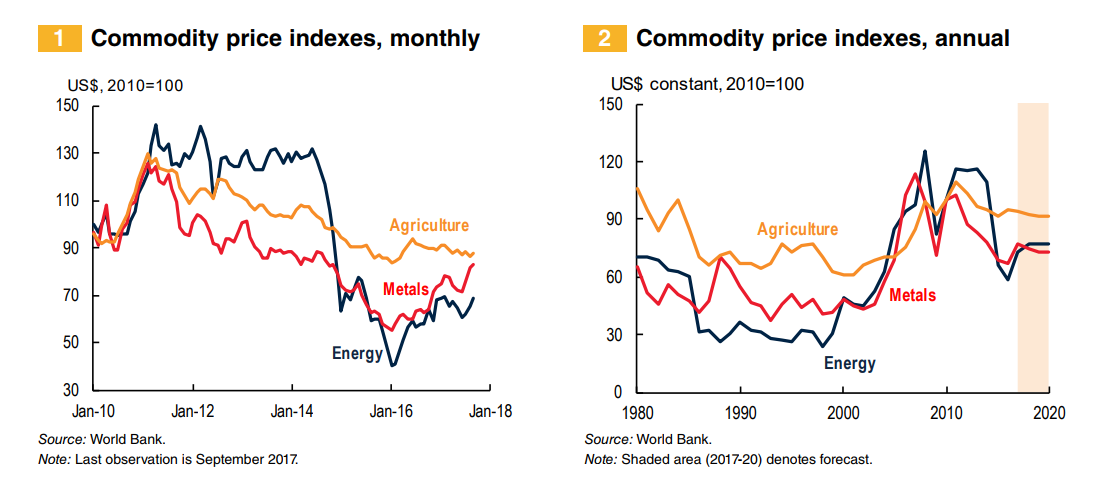

Recent trends Energy prices increased 2 percent in the third quarter of 2017 (q/q), led by a 17 percent leap in coal due to China’s environmentally-motivated measures to cut coal production (Figure 1). Crude oil prices rose marginally from the previous quarter, by 1.6 percent to $50.20 per barrel on average. Despite improved compliance by 22 OPEC (Organization of the Petroleum Exporting Countries) and non-OPEC oil producers to their production cut agreement, oil prices trended lower during the first half of the year, primarily due to large inventories, recovery in U.S. shale oil production, and expanding output from OPEC members Libya and Nigeria, who were exempted from the accord. In the third quarter, prices recovered moderately on declining inventories due to strong global demand, improved compliance among OPEC and non-OPEC producers with the agreement, and stabilizing U.S. shale oil production.

Natural gas prices in Europe and liquefied natural gas (LNG) in Asia, which are partly linked to oil, were steady. Non-energy commodity prices rose over 2 percent in the third quarter of 2017 with large variations among major groups.

Metals prices surged by 10 percent in the third quarter due to strong demand, particularly in China’s property, infrastructure, and manufacturing sectors, and supply constraints due to curtailing excess capacity by the Chinese authorities. Precious metals prices moved up 1 percent as a result of solid investment demand and a weaker dollar.

Agricultural prices declined nearly 1 percent, continuing a trend of weakness that began earlier in the year. Food prices dropped 1 percent, reflecting softer prices for maize, rice, and other food items such as sugar.

Oils and meals bucked the trend by gaining 1 percent on the back of strengthening soybean prices due to a smallerthan-expected North America crop.

Beverage prices increased modestly due to an advance in coffee prices.

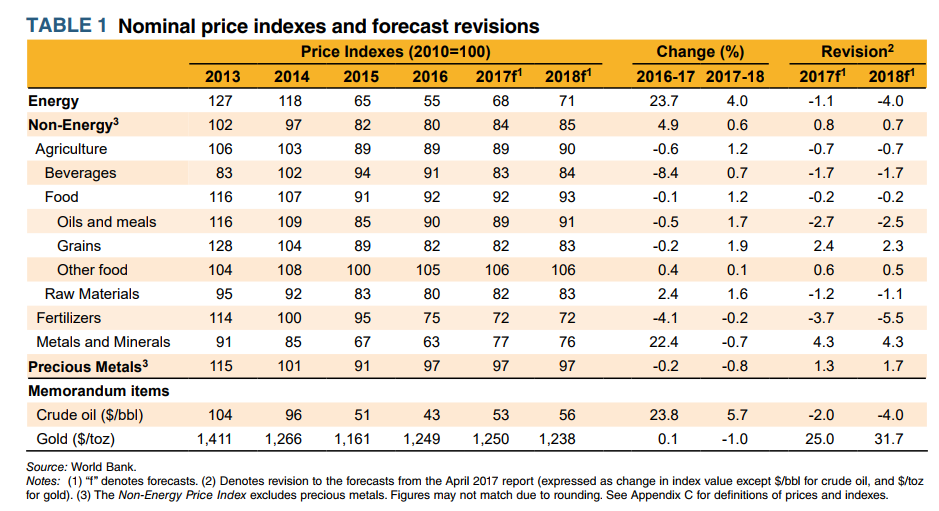

Raw materials prices slipped marginally. Fertilizer prices edged up 2 percent, with rises mainly in urea due to strong demand in Brazil and production outages in North Africa and Middle East. Outlook and risks Energy prices are forecast to climb 4 percent in 2018 after a projected 24 percent leap in 2017 (Figure 2 and Table 2). After falling 5 percent in 2017, nonenergy prices are projected to gain 1 percent in 2018, a marginal upward revision from April 2017. Oil prices are anticipated to average $53/bbl in 2017 and rise to $56/bbl in 2018 on strong oil demand and restraint in OPEC and non-OPEC production (despite projected increases in U.S. shale production).

There are substantial risks to the forecast. Supply to the global market from politically-stressed oil producers, including Iraq, Libya, Nigeria, and the República Bolivariana de Venezuela could be volatile. Agreement among OPEC and non-OPEC countries to cut production more deeply could materially tighten markets. Conversely, failure to extend the agreement could exert downward pressure on prices.

Efficiency gains among U.S. shale producers could boost global oil supplies. Natural gas prices are projected to accelerate 3 percent in 2018. In the United States, prices are expected to gain 4 percent to $3.1/mmbtu on strong domestic demand, expanding exports, and an only-modest increase in production. Slightly larger increases are anticipated in Europe and Japan. Markets are seen remaining well supplied over the next several years due to a surge in LNG capacity, mainly from Australia and the United States. Coal prices are expected to retreat to $70/mt in 2018 following an advance of nearly 30 percent in 2017, as demand slows, especially in China where an environmentallymotivated initiative is underway to reduce coal consumption.

Metals prices are projected to ease slightly in 2018 following a projected 22 percent rise this year. A 10 percent fall in iron ore prices is anticipated to be offset by increases in all base metals prices, particularly due to mine supply tightness in lead (China), nickel (Australia), and zinc (Australia and the U.S.).

Upside risks to price forecasts include stronger-than-projected global demand and production shortages. Downside risks include slower-than-anticipated demand from China and greater-than-expected production— including the restart of idled capacity and an easing of production restrictions in China (as was the case for coal and steel production when prices surged). Precious metals prices are forecast to decline 1 percent in 2017 as expected hikes in interest rates materialize, but with some divergence among categories.

Gold prices are projected to drop 1 percent on expected higher U.S. interest rates. Silver prices are seen slipping slightly as well. Platinum is expected to strengthen 4 percent on advancing catalyst demand and tightening mine supply. Agricultural prices are forecast to recede modestly in 2017 but largely stabilize in 2018. Grain prices are projected to remain broadly stable in 2017 but are anticipated to increase 1 percent in 2018 because of a projected tightness in maize supplies. Oils and meals are seen following a similar path to grains because of supply tightness in the soybean market. Beverage prices, which are expected to tumble almost 8 percent in 2017, will climb only marginally in 2018 because of tightening coffee (Robusta) supplies.

Raw materials prices, which are forecast to move up more than 2 percent in 2017, are projected to tick up even more in 2018 due to tight supplies of natural rubber. Overall, the agricultural price outlook is unrevised from April 2017. Disruptive weather at a global level is not expected during the current season. Fears of a La Niña cycle have not materialized. Thus far, subsidies to crop producers facing lower prices have been isolated events and have not skewed global prices. The large growth of biofuel production during the boom years (2005-11), which had a major effect on prices, is projected to slow.

Fertilizer prices are expected to strengthen 3 percent on moderate demand growth, but new capacity could weigh on prices.

Source: worldbank.org