Last year, we saw the auto sector grapple with challenges like declining EV sales, widespread strikes in the U.S. factories, supply chain disruptions, and rising material costs. However, amidst these turbulent times, there were glimmers of hope and resilience. We saw car and commercial vehicle sales combined top 90mn with an astonishing double digit growth rate.

As 2024 begins, we share Marketsandmarket’s insights and forecasts for an industry on the cusp of transformative changes, with significant advancements in connectivity, electrification, and sustainability.

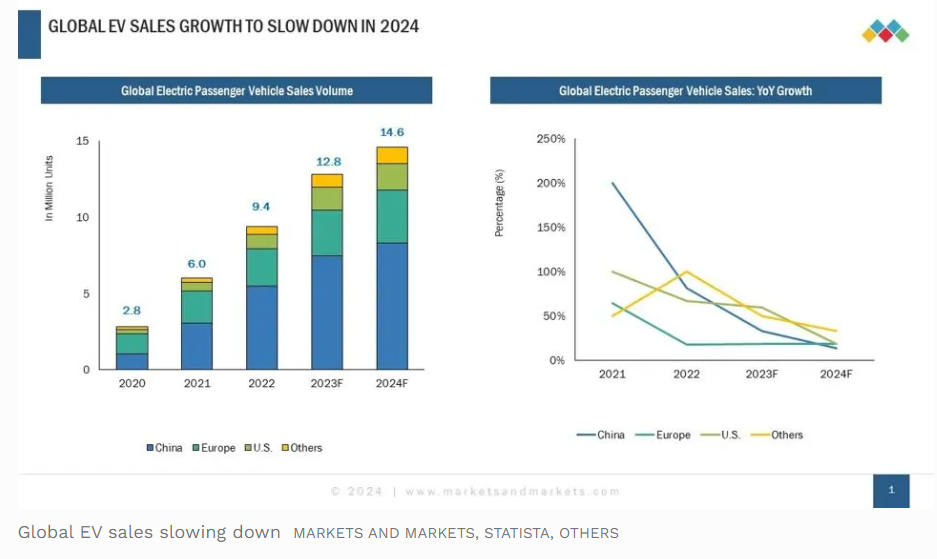

Electric Vehicles: A Slowdown, Not a Stall

Though experiencing a slowdown, EV sales are still projected to rise in 2024. In the U.S., EV sales in 2024 are expected to grow y-o-y by merely 16% compared to ~64% in 2023. In China growth in 2024 would be 11.1% compared to 36.5% in 2023. Factors like reduced incentives, limited charging infrastructure, and the saturation of early adopters are significant hurdles. However, this slowdown is prompting major players like GM, VW and Ford to adjust their strategies, with some lowering prices and delaying new models.

China’s Continued Dominance in the EV Market, globally not locally

Amidst the sleek lines of cutting-edge EVs, China stands tall as a market giant and a global influencer, contributing 60% to worldwide EV sales. Its controlled supply chain, relentless innovation, and growing global presence solidify its leadership. By 2025, China is expected to capture 12% of the European EV market, fueled by competitive pricing, cutting-edge battery technology, and the growing popularity of Chinese electric car brands in the U.K. and other European and Asian markets. In 2024, China will firmly establish itself as a powerhouse in the EV revolution both in the home market and globally.

Surging Online Sales of Vehicles

Global online car sales where the full car buying experience is on-line is set to surge, reaching 7.1-7.3 million units by 2024. Many EV manufacturers are venturing into online sales, which are available in all major markets. North America leads the charge with a share of more than one-third of the global market, with APAC catching up rapidly, driven by tech-savvy younger generations. This trend encompasses used and new cars, with online platforms offering convenience and transparency. The automotive landscape is headed towards a future where fully online sales contribute significantly to total new car sales.

Redefined Luxury: A New Class of Car Emerges

Luxury automotive trends are undergoing a paradigm shift, with traditional players redefining the ‘ultra-luxury segment’ and non-luxury OEMs strategically positioning top-end models as luxury vehicles. In the last couple of years, we saw a significant shift with SUVs becoming the ultimate uber luxury car of choice for the mega-rich, influencing brands like Aston Martin and Lamborghini. EVs are increasingly part of the luxury segment, expected to account for 15-17% of sales by 2024. With its growing affluent population, China is driving this luxury market transformation.

Plugging In for the Future: The EV Charging Revolution

Expect a significant increase in charging stations in 2024, reaching around 2 million globally. Governments and OEMs are investing heavily in infrastructure, with DC fast-charging and ultra-fast charging leading the way. China is a significant player, with its fast-charging technologies expected to triple by 2024. E-Forecourts and depot charging solutions will also see significant growth. The number of chargers for new electric commercial vehicles is expected to touch 347K units in 2024 and growing to 1.14mn by 2030, with a majority of the increase contributed by DC chargers. Fast and ultra-fast chargers in depot settings for electric commercial vehicles are expected to grow at a CAGR of ~35% between 2023 and 2030.

The Used Car Market Takes Center Stage

The global used car market is experiencing significant growth, especially in APAC. In 2023, it saw a 3-4% increase, with sales of 94-96 million vehicles, and is projected to grow by 5-6% in 2024. The B2C segment is becoming more dominant, and it is expected to exceed 50% market share in APAC and North America, indicating a shift towards a more organized market. Despite mixed results in recent IPOs from companies like Vroom, Auto1, Cazoo, CarTrade, and Carvana, the market is set for transformation. The rise of online used car sellers and aggregators, such as Droom in India, is disrupting the industry, pointing to a future shaped by innovation, customer trust, and convenience.

5G Takes the Wheel: The Connected Car & Living Revolution

This isn’t just a faster internet; I would call it a revolution on wheels. The 5G technology is set to transform the automotive industry, with major players like Audi, Mercedes-Benz, GM, Ford, Skoda, and Geely adopting it in their smart factories to improve automation, safety, and efficiency. This will only enhance in-car experiences with faster data transmission, low-latency communication, and improved navigation and infotainment systems. The automotive sector is expected to see a 30-35% annual growth rate in 5G adoption over the next few years. 5G will also facilitate what we term as “car as a connected living solution”, whereby the car in future will become an element of our connected home, connected workplace, connected energy, connected city and more, providing an integrated and seamless experience which will allow OEMs to generate addional revenues during the vehicle life-cycle.

Generative AI: Shaping the Future of Cars

Generative AI is transforming the automotive sector, impacting vehicle design, navigation, predictive maintenance, voice assistants, manufacturing, supply chain, and quality control. It will enhance the safety, efficiency, and personalization of in-car interactions. Major automotive companies are increasingly adopting this technology—Toyota and BMW for vehicle design, Tesla in Advanced Driver-Assistance Systems (ADAS), Continental in digital cockpits, and Mercedes Benz in Personal Voice Assistants. This marks a shift towards more intelligent and responsive automotive technologies.

Gearing Up for the Future: Other Trends to Watch in 2024

Smart manufacturing, gigacasting, digital twins, and the impending impact of Euro-7 norms are poised to shape the industry in 2024, bringing about efficiencies and redefining operational strategies.

Conclusion

2024 is expected to be filled with breakthroughs and transformative experiences, despite a slowdown in growth rates for this a year. A landmark of 100 million units in sales is on track to be reached, including both passenger and commercial vehicles, by 2026. It remains to be seen what the year has in store for us.

Source: forbes.com