Prices for most industrial commodities continued to rise in the fourth quarter from their lows in early 2016, while most agricultural prices declined. Crude oil prices are forecast to rise to $55 per barrel in 2017 from $43/bbl in 2016 following agreements among some Organization of the Petroleum Exporting Countries (OPEC) producers and non-OPEC producers to limit output in the first half of 2017. Metals prices are projected to rise 11 percent as a result of supply constraints, including large lead and zinc mine closures. Agricultural commodities prices are anticipated to rise slightly in 2017, with increases in oils and meals and raw materials, offset by declines in grains following favorable weather conditions in Europe, North America, and Central Asia. This edition of Commodity Markets Outlook analyzes the recent investment weakness in commodity-exporting emerging market and developing economies (EMDEs) and concludes that the deceleration reflects elevated uncertainty, deteriorated terms of trade, and increased private debt burdens.

Trends. Energy prices rose 11 percent in the fourth quarter of 2016 from the previous quarter with strong gains in all fuels (Figure 1). Coal prices soared 38 percent on strong demand and continued supply tightness in China resulting from government efforts to reduce coal capacity. Natural gas prices rose 8 percent, with increases in all three regions due to stronger demand and a number of liquefied natural gas (LNG) production outages, notably the Gorgon project in Australia. U.S. natural gas prices were boosted in December by colder-than-normal weather and large draws from storage.

Crude oil prices jumped 10 percent in the fourth quarter, averaging $49.1/bbl, following agreements by both OPEC and non-OPEC producers to reduce output by nearly 1.8 million barrels per day in the first half of 2017. The oil market continues to rebalance amid steady demand growth, while sharply lower investment in non-OPEC countries has led to lower production, notably in the U.S. shale oil sector. Global stocks, however, remain stubbornly high, particularly in the United States, and were a main reason for oil producers to limit production.

The Non-Energy Commodity Price Index rose 1 percent in the fourth quarter with large variations among major groups. Metals prices increased 10 percent due to strong demand in China and tightening supply, notably for zinc and lead because of the closure of several large mines in Australia, Canada, and Ireland. Precious metals prices fell 9 percent on weakening investment demand due to a rising U.S. dollar and higher real interest rates. Grains prices declined 4 percent due to record crops in rice, maize, and wheat. The increase in some edible oils prices reflects tightening supplies from East Asia producers as a result of lower palm oil yields. The Beverage Price Index declined 3 percent in response to a supply-driven drop in cocoa prices, although Robusta coffee prices rose on expectations of lower Brazilian output.

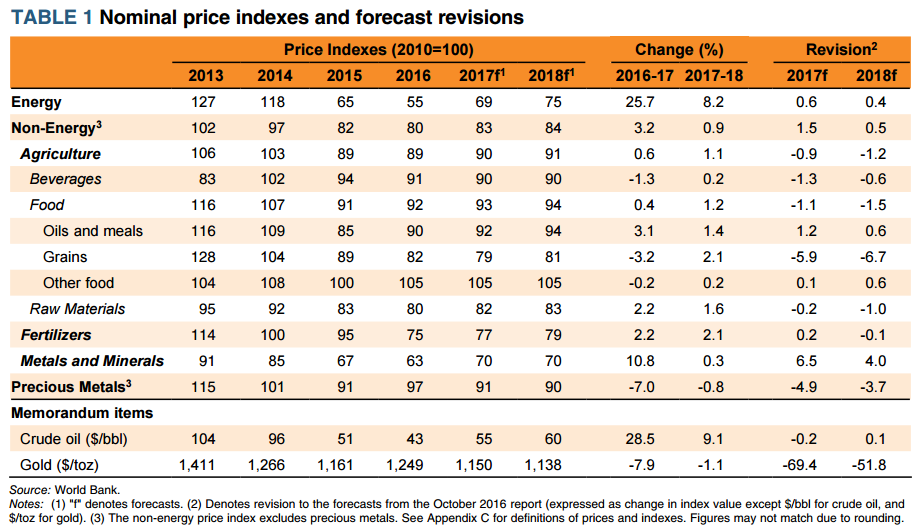

Outlook and risks: Energy and non-energy commodity price indexes are projected to increase in 2017 by 26 and 3 percent, respectively. Both are slight upward revisions from October (Table 1). Industrial commodities are expected to outperform other markets due to strong demand and tight supplies. Prices of beverages, grains, and precious metals are exceptions.

Oil prices are projected to average $ 55/bbl in 2017, unchanged from the October forecast, and an increase of 29 percent from the 2016 average oil price. The increase largely reflects partial compliance (in line with historical precedent) to the recent agreement between OPEC and non-OPEC producers. The market is expected to tighten in 2017, particularly in the second half of the year, which would help reduce the large stock overhang (Figure 2). Onshore U.S. lower-48 states oil production (which includes shale) is projected to bottom out in the second quarter of 2017 and rise moderately thereafter. Prices are projected to increase to $60/bbl in 2018 assuming a balanced market and no additional OPEC supply restraint.

Non-energy commodity prices are expected to increase 3 percent in 2017—the first increase in six years for both metals and agricultural prices. After dropping 6 percent in 2016, metals prices are forecast to rise 11 percent amid increasing supply tightness, particularly for lead and zinc. Downside price risks for metals include a slowdown of growth in China and higherthan-expected production, while upside risks relate to greater-than-expected government-related supply restraints in Asia, and reluctance by producers to activate idle capacity. Precious metals prices are projected to decline in 2017 as benchmark interest rates rise and safe-haven buying ebbs. Although the Agricultural Price Index is expected to remain stable in 2017, the outlook for its components varies considerably, depending on supply conditions. Small increases are expected for oils and meals as well as raw materials components (3 percent and 2 percent, respectively) due to lower supplies from East Asia as a result of adverse weather. This will be offset by a decline in grains prices (down 3 percent) on an improved supply outlook following favorable growing conditions in Central Asia, Europe, and North America. Upside risks to the agricultural price forecast include worsening weather conditions in East Asia and South America and a larger-than-expected increase in energy prices, which are a key cost component to most food prices. Risks of supply disruptions from La Niña have diminished. Downside risks include the escalation of agricultural subsidies, especially in grains, which could encourage greater production.

Special Focus on investment weakness in commodityexporting EMDEs. Investment growth in commodityexporting EMDEs has slowed substantially, from 7.1 percent in 2010 to 1.6 percent in 2015. In about twothirds of commodity-exporting EMDEs, investment growth failed to reach its long-term average in 2015. Both public and private investment were weak. Subdued growth prospects and deteriorating terms of trade lay behind the deceleration in investment. Given the limited room for fiscal or monetary stimulus in most commodity exporters, the Special Focus argues that structural reforms are critical to enhance business environments, encourage economic diversification, and improve governance. These measures could boost public and private investment and attract foreign direct investment, resulting in brighter growth prospects in the longer term.

Source: worldbank.org