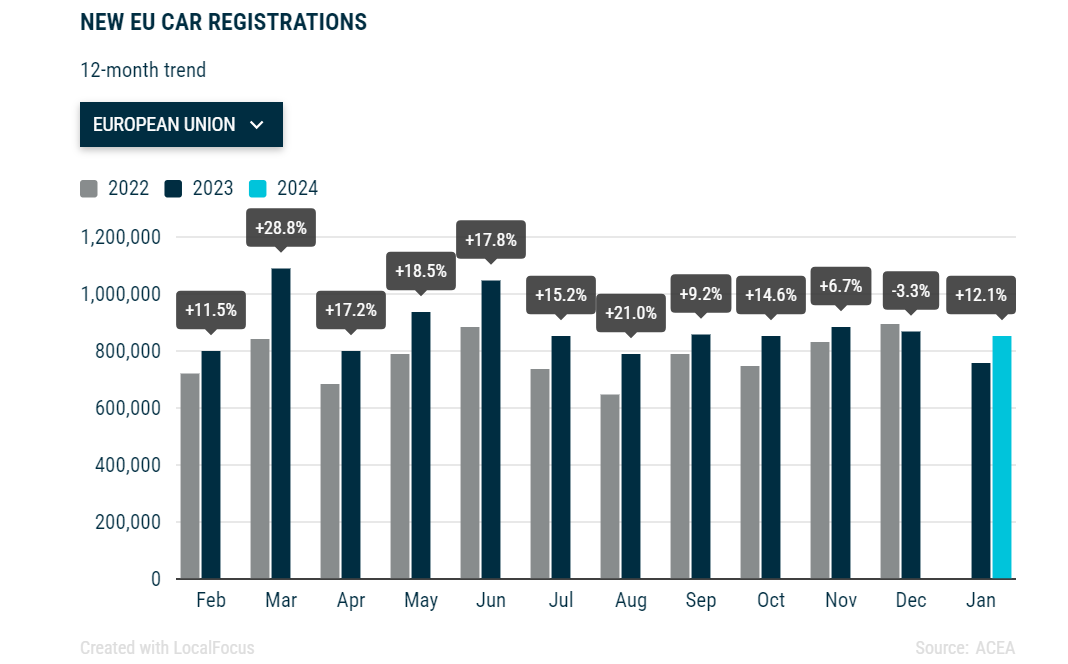

In January 2024, the EU new car market rebounded from the slowdown experienced in December 2023, with year-on-year car registrations increasing by 12.1% to 851,690 units.

Notably, the bloc’s major markets all saw significant growth, with Germany (+19.1%), Italy (+10.6%), France (+9.2%), and Spain (+7.3%) achieving either high single-digit or double-digit gains.

In January 2024, new battery-electric car sales surged by 28.9% to 92,741 units, representing a total market share of 10.9%.

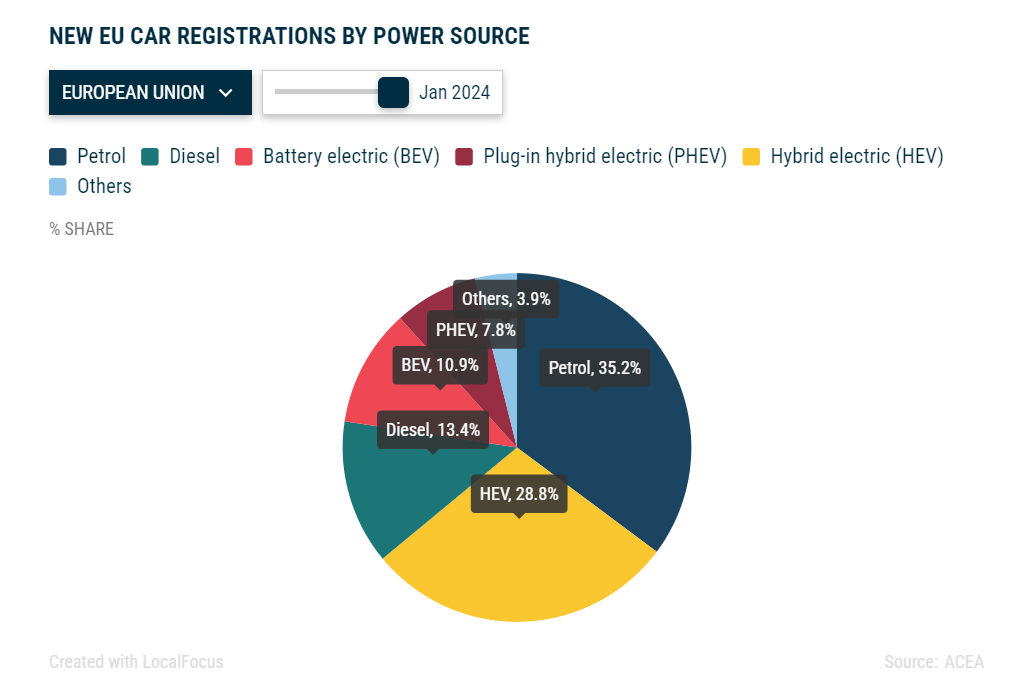

New EU car registrations by power source

In January, battery electric cars accounted for 10.9% of the market share (up from 9.5% in January 2023), while hybrid-electric cars commanded a share of nearly 30%, solidifying their position as the second most preferred choice among EU car buyers. The combined market share of petrol and diesel cars totalled almost 50% in January 2024, marking a decline from 54% one year ago.

Electric cars

In January 2024, new battery-electric car sales surged by 28.9% to 92,741 units, representing a total market share of 10.9%. The four largest markets in the region – together covering 66% of all battery electric car registrations – recorded robust double-digit gains: Belgium (+75.5%), the Netherlands (+72.2%), France (+36.8%), and Germany (+23.9%).

In January, new EU registrations of hybrid-electric cars increased by 23.5%, propelled by significant growth in the four biggest markets: Spain (+26.5%), France (+29.9%), Germany (+24.3%), and Italy (+14.2%). This led to the sale of 245,068 units in the first month of 2024, representing 28.8% of the EU market share.

Sales of plug-in hybrid electric cars rebounded after a decline in December 2023, rising by 23.8% to 66,660 units in January 2024. This growth was primarily driven by significant increases in key markets such as Belgium (+65.2%) and Germany (+62.6%). As a result, plug-in hybrid electric cars now represent 7.8% of total car sales in the EU.

Petrol and diesel cars

In January 2024, the EU petrol car market expanded by 4%, propelled by notable increases in key markets such as Italy (+26.7%) and Germany (+16.9%). Despite maintaining its lead with 35.2% of the market in January, the share of petrol cars decreased from 37.9% in the same month in 2023.

Conversely, the EU diesel car market contracted by 4.9% in January. This decline was evident in several markets, including three of the largest: France (-23.4%), Spain (-10.2%), and Italy (-8.7%). However, Germany diverged from this trend with a 4.3% growth rate. In January 2024, diesel car sales reached 114,415 units, accounting for a market share of 13.4%, down from 15.8% in 2023.

Source: acea.auto