The overall volume for the full year of 2023 surpassed 1.5 million units, reflecting a substantial 37% increase compared to 2022. The battery-electric car market share reached 14.6% in 2023.

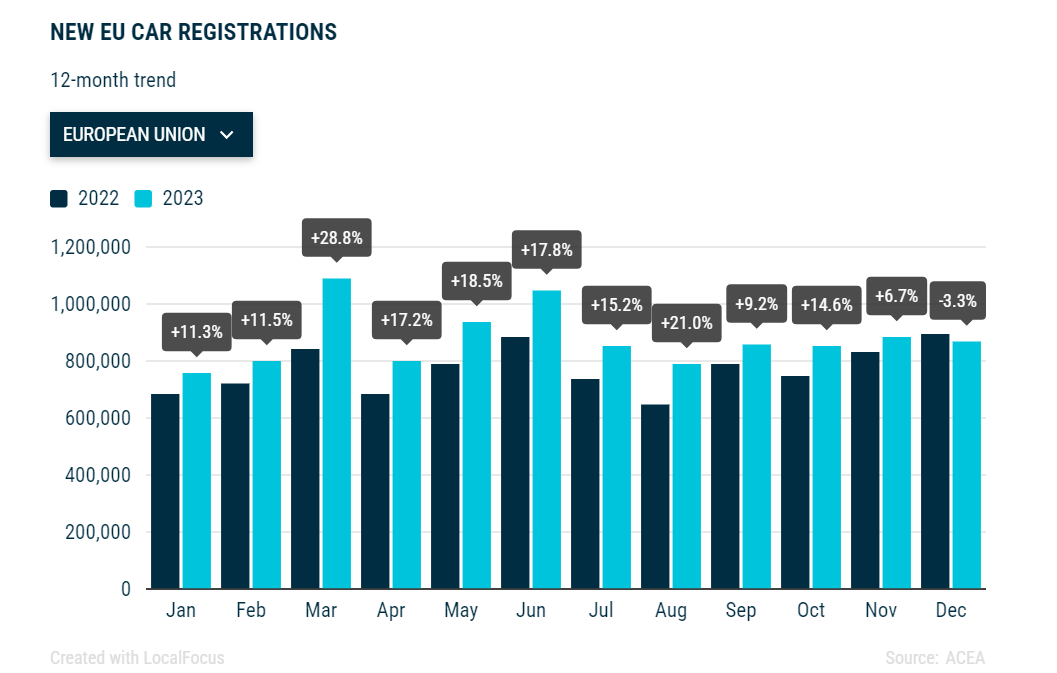

In December 2023, the EU car market experienced a 3.3% decline, recording 867,052 units in sales. This drop can be attributed to the high baseline performance in December 2022. December also marked the first month of contraction after 16 consecutive months of growth.

Notable increases were observed in top markets such as France (+14.5%) and Spain (+10.6%). In contrast, the German car market declined by a significant 23% in December.

In 2023, the EU car market concluded with a solid 13.9% expansion compared to 2022, reaching a full-year volume of 10.5 million units. All EU markets grew in the past year except for Hungary (-3.4%). Double-digit gains were recorded in most markets, including three of the largest: Italy (+18.9%), Spain (+16.7%), and France (+16.1%). Conversely, Germany recorded a more modest 7.3% year-on-year increase, influenced by its weaker December performance.

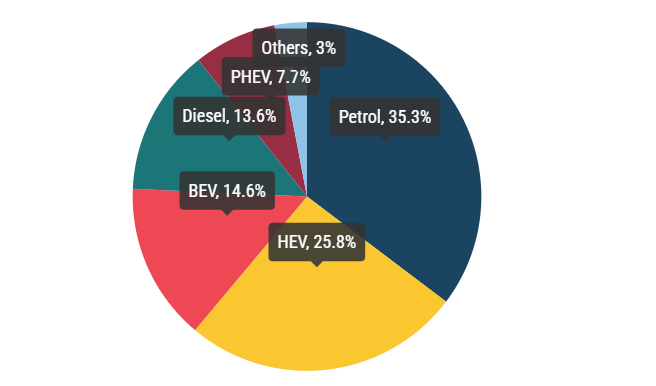

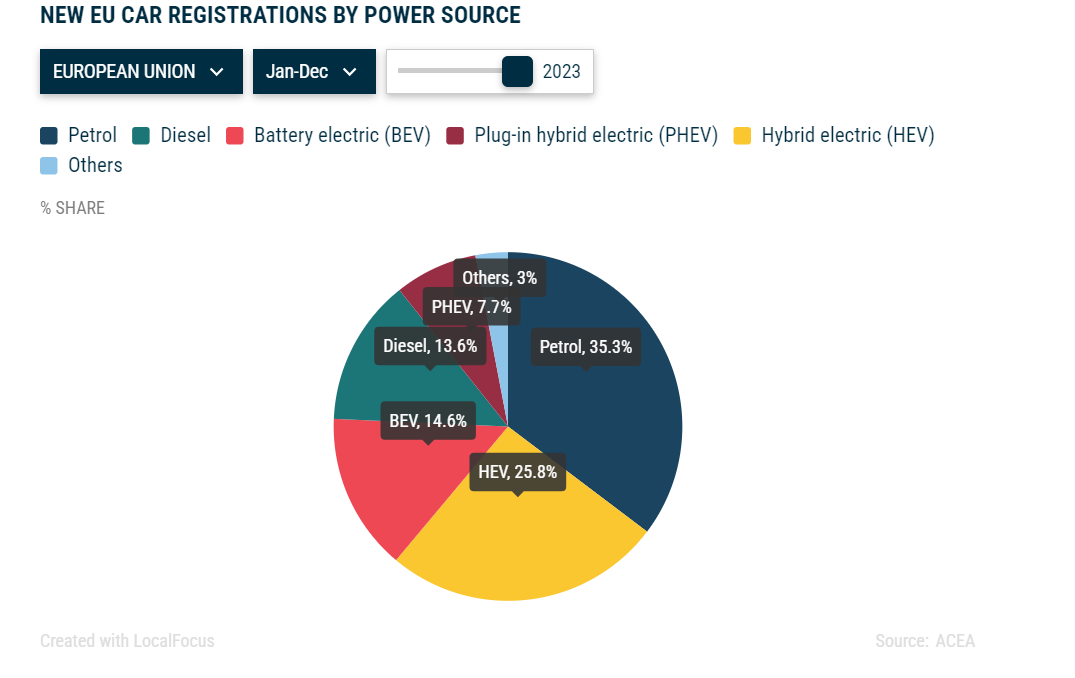

New EU car registrations by power source

Battery-electric cars established themselves as the third-most-popular choice for buyers in 2023. In December, market share surged to 18.5%, contributing to a 14.6% share for the full year, surpassing diesel, which remained steady at 13.6%. Petrol cars retained their lead at 35.3%, while hybrid-electric cars claimed second spot, commanding a 25.8% market share.

Electric cars

In December 2023, new battery-electric car sales declined for the first time since April 2020 (during the COVID-19 pandemic’s peak), dropping by 16.9% to 160,700 units. This decrease can be attributed to a comparatively robust performance in December 2022 and a significant downturn in Germany (-47.6%), the largest market for this power source. Despite this, the overall volume for the full year of 2023 surpassed 1.5 million units, reflecting a substantial 37% increase compared to 2022. The battery-electric car market share reached 14.6% in 2023.

In December, new EU registrations of hybrid-electric cars surged by 26%, driven by impressive gains in three of the four largest markets: Germany (+38%), France (+32.6%), and Spain (+24.3%). This contributed to a cumulative 29.5% increase in 2023, resulting in over 2.7 million units sold in 2023 – a quarter of the EU market share.

In contrast, sales of plug-in hybrid electric cars ended the year on a downward trend, declining by a significant 40.2% to 71,546 units in December 2023. Increases in key markets, Belgium (+19.7%) and France (+17.3%), were insufficient to offset the substantial downturn in Germany (-74.4%), the largest market for this power source. As a result, the EU plug-in hybrid electric car market decreased by 7% compared to 2022 and now represents a 7.7% market share.

Petrol and diesel cars

In December 2023, the EU petrol car market grew by 5.1%, driven by significant contributions from key markets like Italy (+24.9%) and Germany (+16.1%). This led to a total of 3.7 million units sold, a 10.6% increase compared to the previous year. Despite maintaining the lead with a 35.3% market share throughout 2023, petrol cars experienced a slight decline from 36.4% in 2022.

The EU diesel car market continued its downward trajectory in December, contracting 9.1%. This decline was evident in several key markets, including three of the largest: Spain

(-26.5%), France (-22.2%), and Italy (-19.7%). However, Germany diverged from this trend with 10.3% growth. In 2023, diesel car sales reached 1.4 million units, accounting for a market share of 13.6%, declining from 16.4% in 2022.

Source: acea.auto