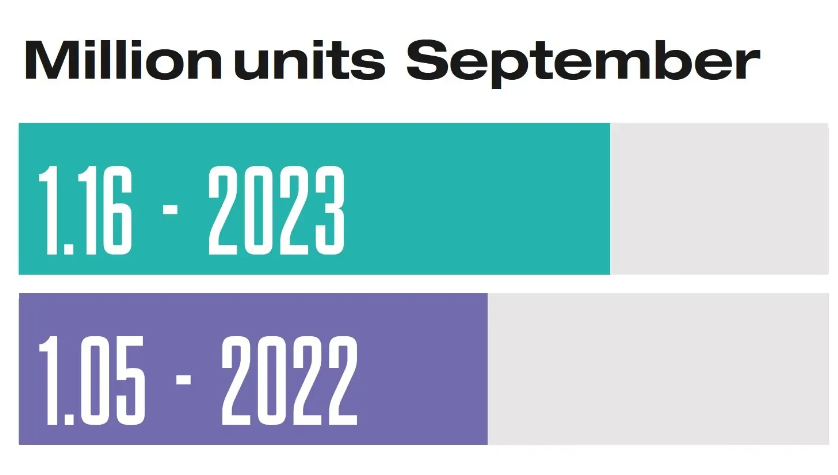

European new vehicle registrations increased by 10% to 1,155,648 units in September, marking the slowest rate of growth recorded this year. In comparison to September 2020, when the pandemic was impacting the market, total volume was down by 11%. Felipe Munoz, Global Analyst at JATO Dynamics, commented: “Despite financial pressures such as rising inflation and interest rates, alongside geopolitical uncertainty, the European car market has seen consistent growth over the course of this year. While EVs have been a key driver of this growth, it is unlikely that this will be sustained for much longer, considering truly affordable ICE alternatives now remain a rarity in the market.”

- European car market grew at slowest rate in 2023

- SUVs accounted for 54% of total registrations in September

- Demand for BEVs increased by 13%

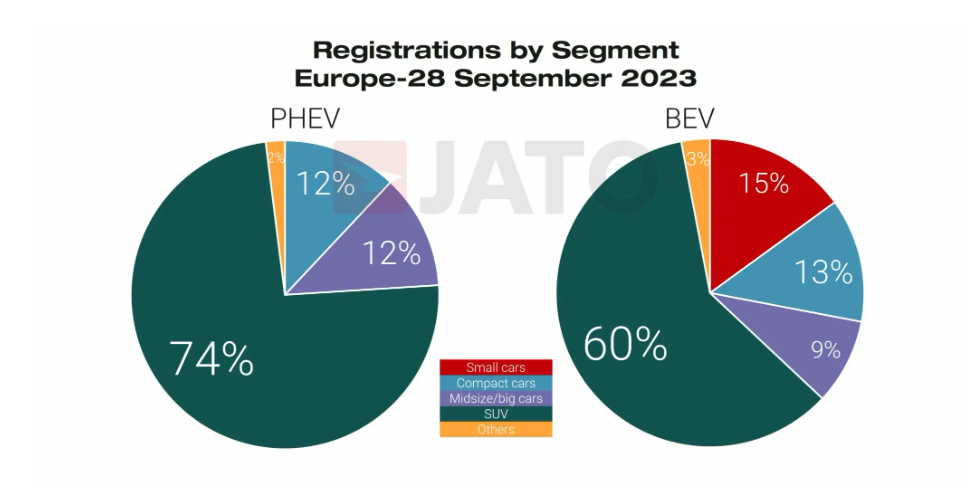

The demand for electric vehicles was high considering the lack of affordable EVs on the market. Last month, EV registrations totalled 186,380 units accounting for 16.1% of the market – an increase of 13% when compared to September 2022. Year to date, a total of 1,465,249 new electric passenger cars have been registered, marking a 47% increase when compared with the same period last year. Munoz, added: “Despite higher prices, these vehicles have a considerable presence within the market. Now, we will only see this growth continue if and when cheaper alternatives arrive.”

SUVs dominate

The popularity of SUVs continues to support BEV sales, accounting for 60% of total BEV volumes in September. The market share of these vehicles was even higher than the record 54% seen in the overall market. Munoz, continued: “The impact of SUVs on the traditional market has fed through to the EV market. Their strong sales performance is largely due to the increasingly broad offer spanning both luxury and smaller more affordable models.”

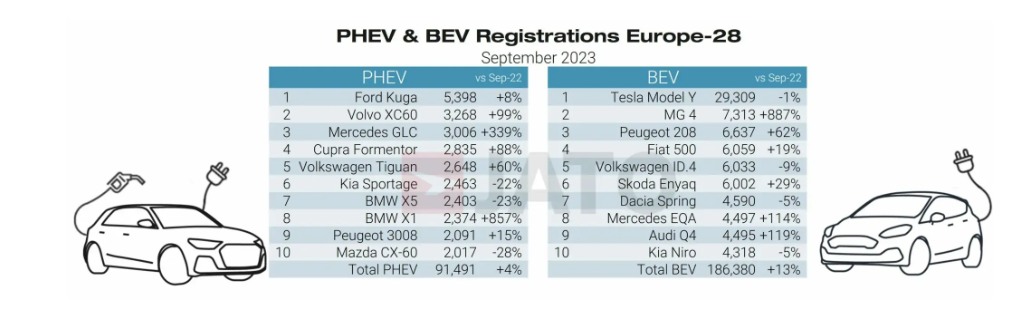

Last month, Tesla’s electric SUV, the Model Y, was Europe’s most popular new car with 29,309 units registered – topping both the monthly and year-to-date rankings. Munoz, added: “It’s very likely that the Tesla Model Y will finish the year as Europe’s most registered new vehicle. Considering Tesla’s strong performance across its range, the brand also has the potential to shock the industry by outselling legacy local OEMs such as Fiat or Citröen.”

Despite the success of the Model Y, Tesla’s registrations fell by 19% in September due to declining demand for the Model 3. The midsize sedan is currently undergoing a facelift which can damden sales performance in the short term as consumers wait for the arrival of the new model.

In contrast, MG registered more than 26,500 units, marking a 91% increase on the same month last year. This takes the brand’s year-to-date volume to almost 163,200 units, up by 126%. In terms of volume, MG is already outperforming competitors including Suzuki, Mazda, and Mini. Last month, the MG 4 was Europe’s second most registered electric vehicle – its best performance since being introduced in September 2022. Over this period, MG has registered more than 57,800 units of this compact hatchback.

The MG ZS also has also been gaining traction – up by 118% to 11,862 units becoming Europe’s 12th best-selling SUV during the month. Other models that performed well include the Nissan Juke, up by 93% to 8,583 units; the Seat/Cupra Leon (+93%); the BMW X3 (+53%); the Mercedes GLC (+269%); and the BMW X1 (+177%).

Source: jato.com