The October 2025 World Bank Commodity Markets Outlook reports that global commodity prices have declined below 2024 levels, driven by subdued economic activity, persistent trade tensions, policy uncertainty, and weather-related supply shocks. Energy prices, particularly oil, have fallen sharply, pulling down the overall commodity price index.

Recent Developments

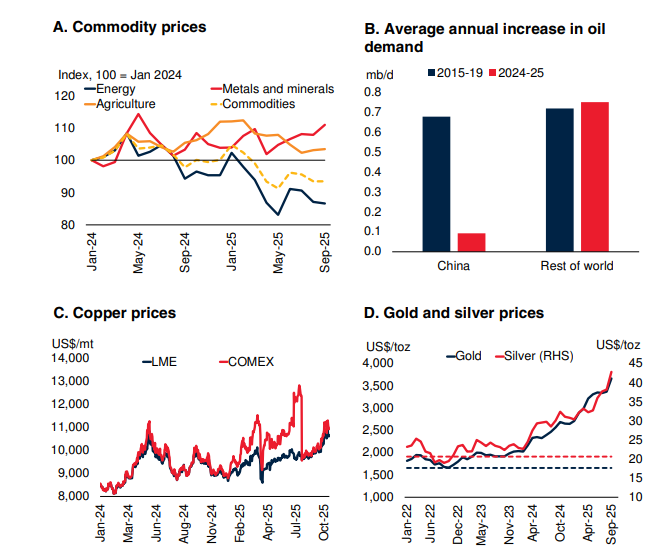

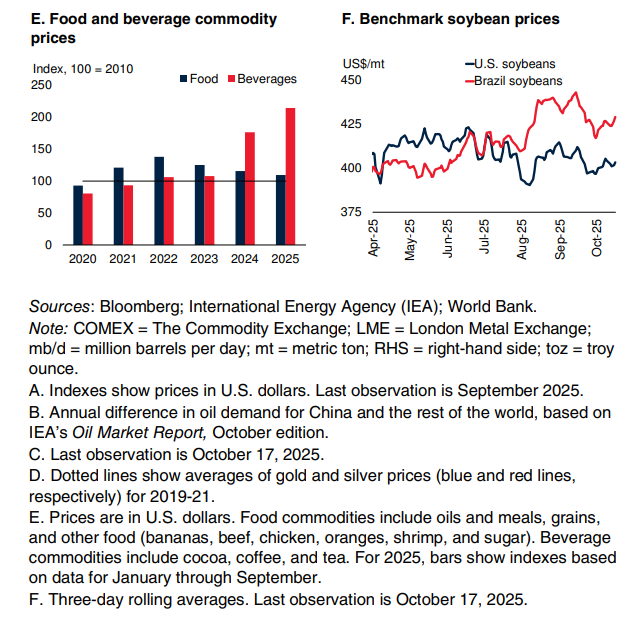

Energy markets experienced a sharp drop in oil prices, mainly due to oversupply and weak demand growth in China. Natural gas prices in the U.S. surged by 64% amid higher European LNG demand, while metal prices rebounded slightly in late 2025 following earlier declines. Precious metals, especially gold and silver, rose to record highs due to geopolitical uncertainty and safe-haven demand. Agricultural prices edged down for a third straight quarter as global grain supplies improved, but fertilizer prices rose by 19%, squeezing farmer margins.

Outlook

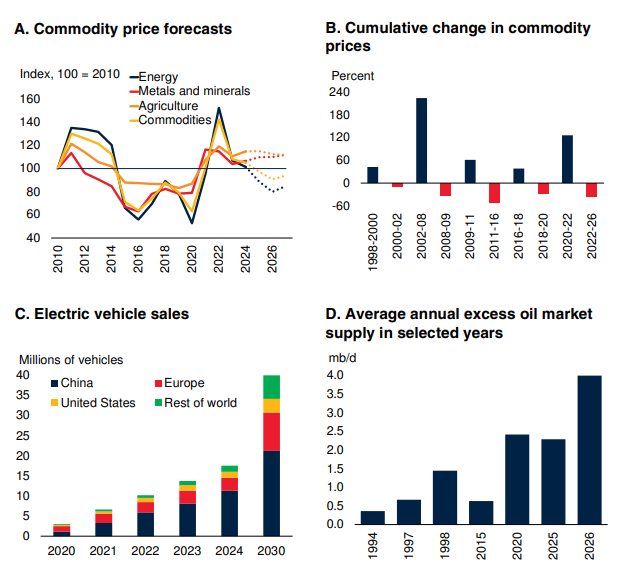

The World Bank projects overall commodity prices to fall by 7% in 2025 and again by 7% in 2026, marking a fourth consecutive year of decline. Energy prices are expected to remain the main driver of disinflation globally. Non-energy commodities, including metals and agriculture, are forecast to remain stable or edge down slightly. Precious metals are expected to continue rising, with gold forecast to reach 180% above its 2015–19 average.

Risks

Downside risks include weaker global growth, extended policy uncertainty, and oil oversupply. Upside risks stem from geopolitical tensions, further sanctions, extreme weather (e.g., La Niña), and accelerated data center expansion increasing energy and metals demand.

Broader Implications

Lower oil prices offer fiscal space for oil-importing nations to reduce subsidies and invest in health, education, and infrastructure. Energy price declines are expected to shave 0.2 percentage points off global inflation in 2026. Food security is projected to improve modestly, with the global population facing hunger expected to fall to 634 million in 2025. However, high fertilizer prices may reduce crop yields.

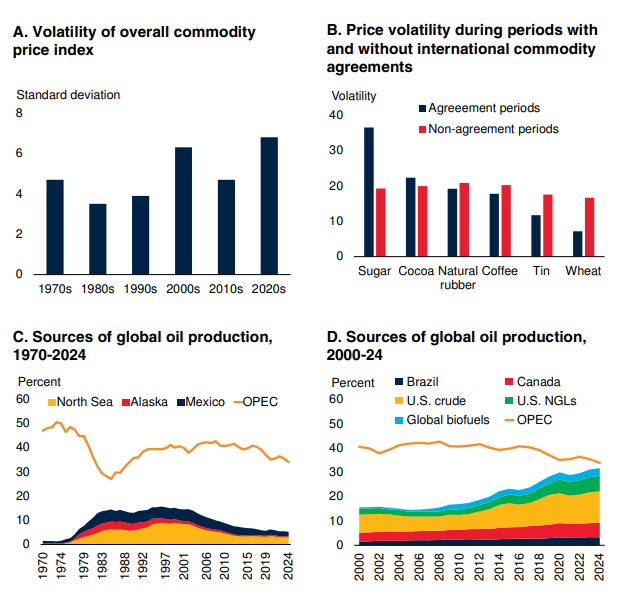

Special Focus: Commodity Agreements

The report revisits the historical performance of international commodity agreements aimed at stabilizing prices. While temporary interventions can ease volatility, long-term control efforts have largely failed. The World Bank emphasizes diversification, innovation, transparency, and market-based pricing as more sustainable solutions for managing commodity price fluctuations.